بِسۡمِ اللهِ الرَّحۡمٰنِ الرَّحِيۡمِ

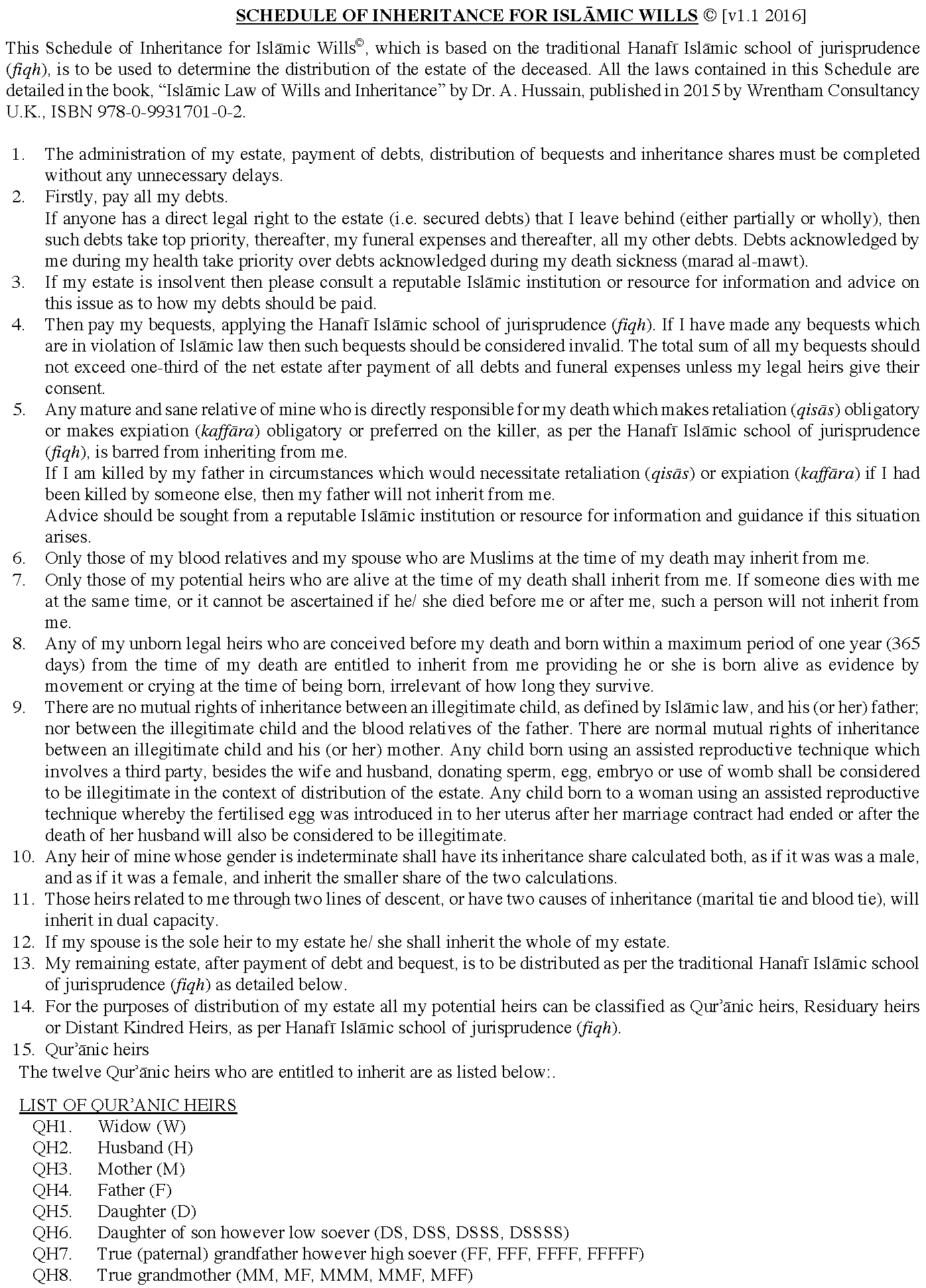

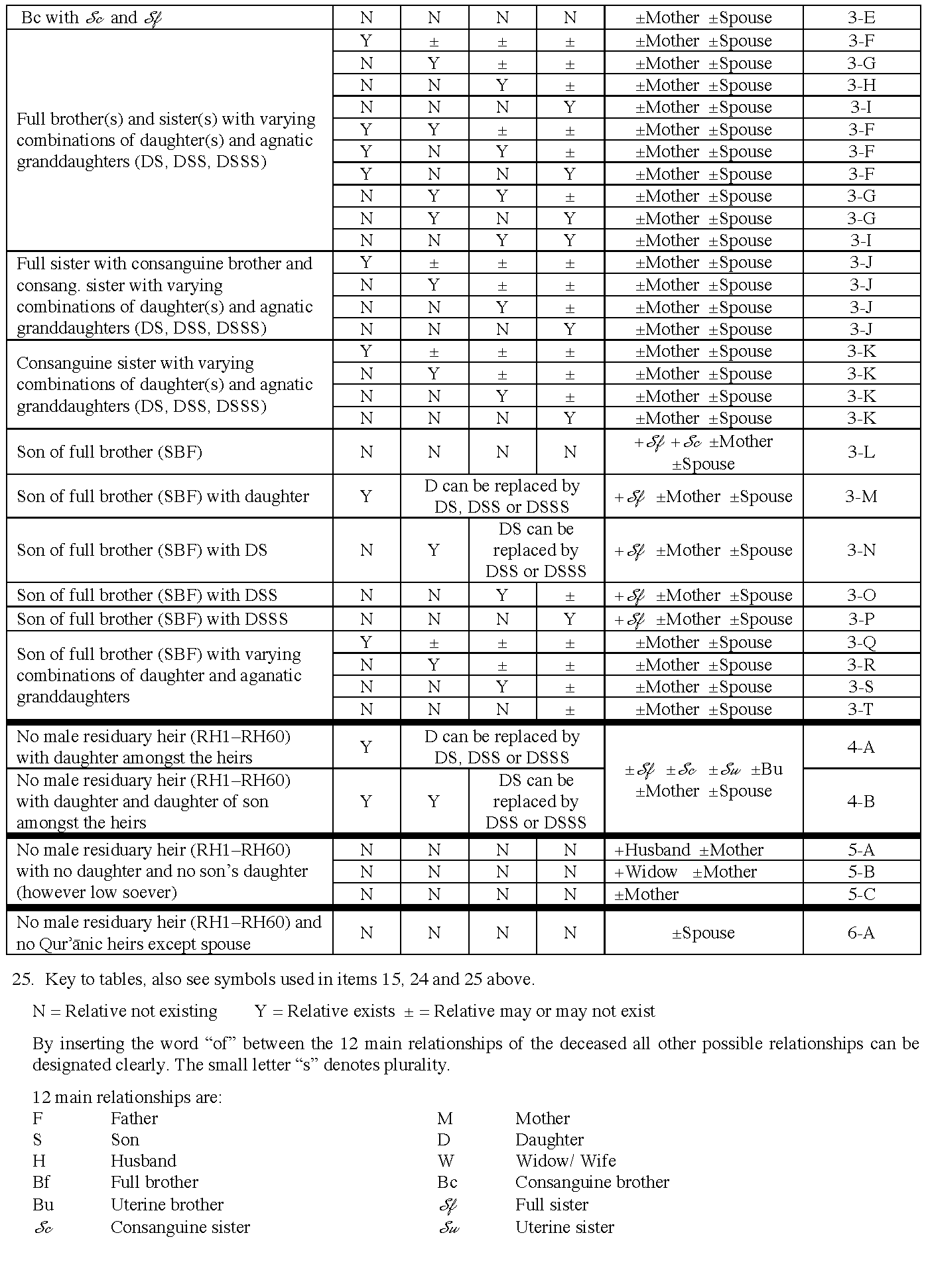

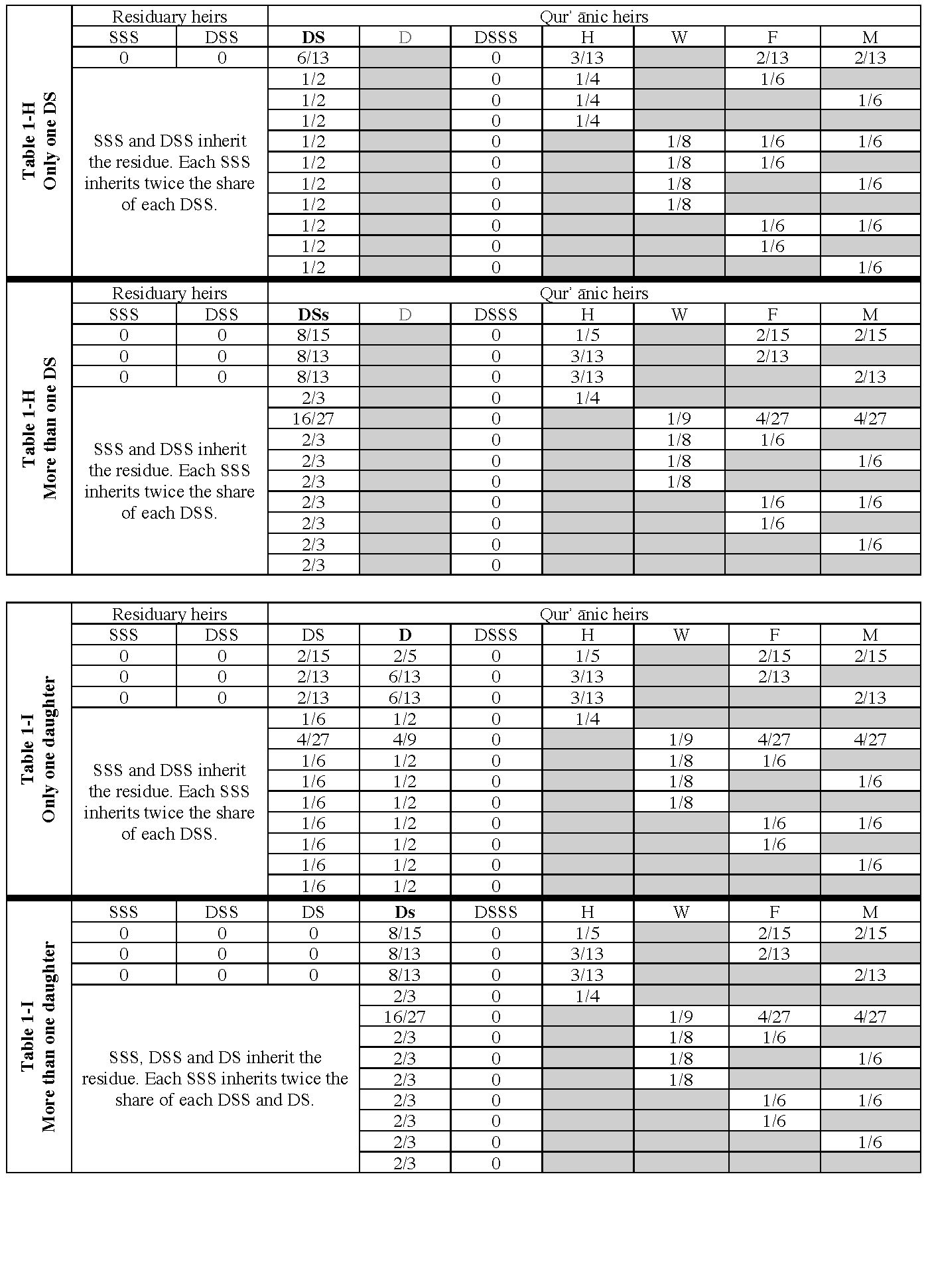

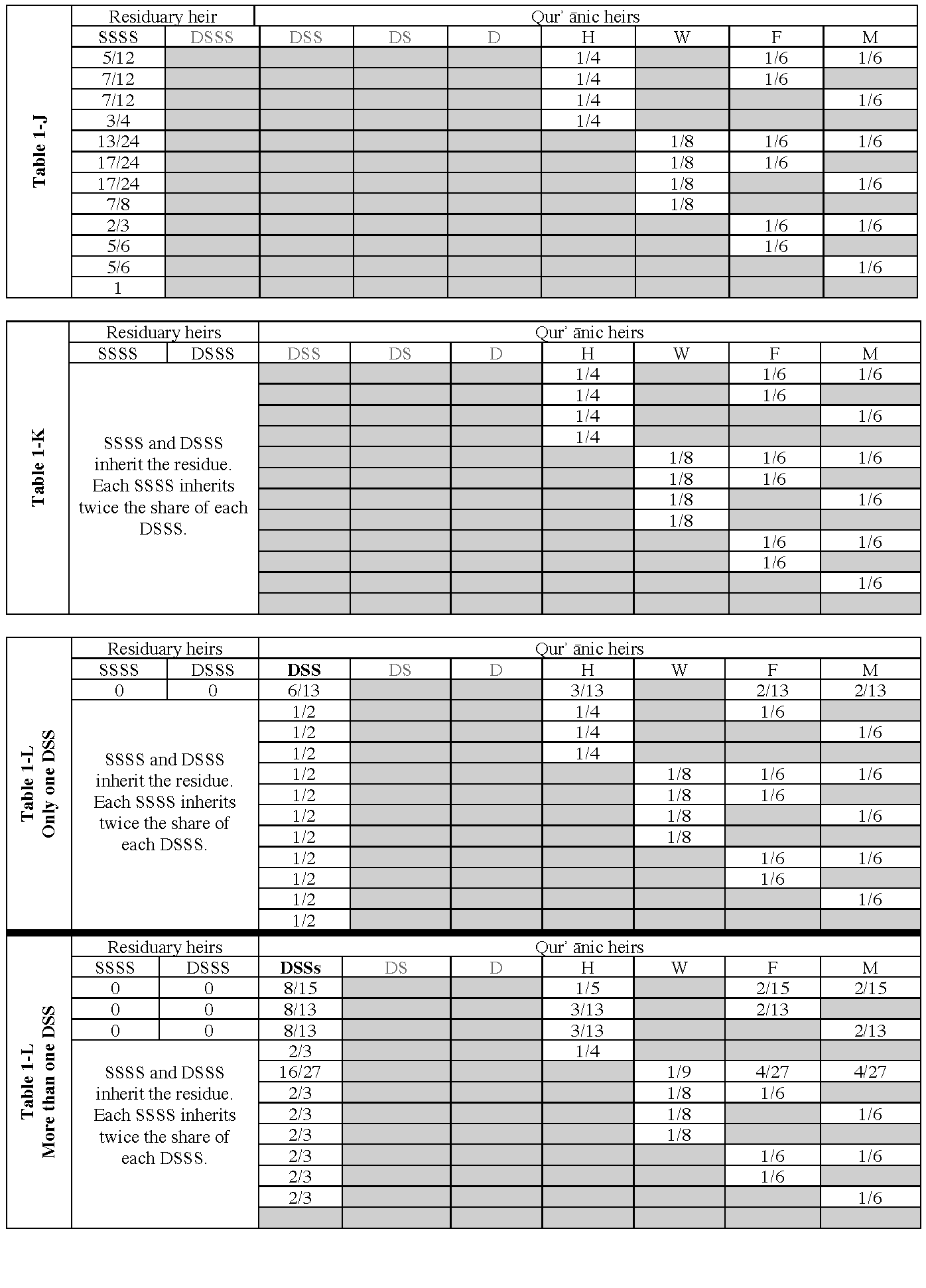

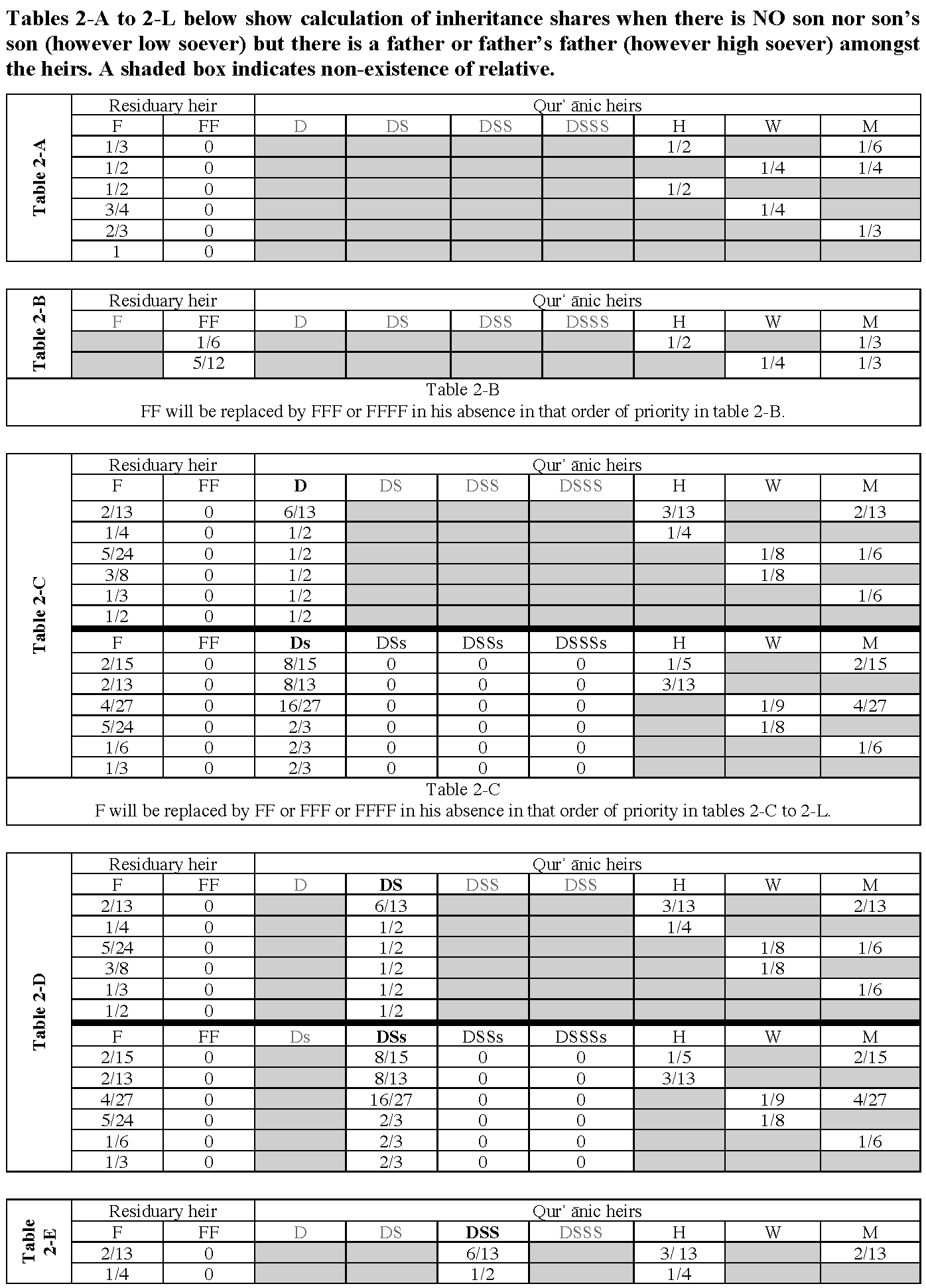

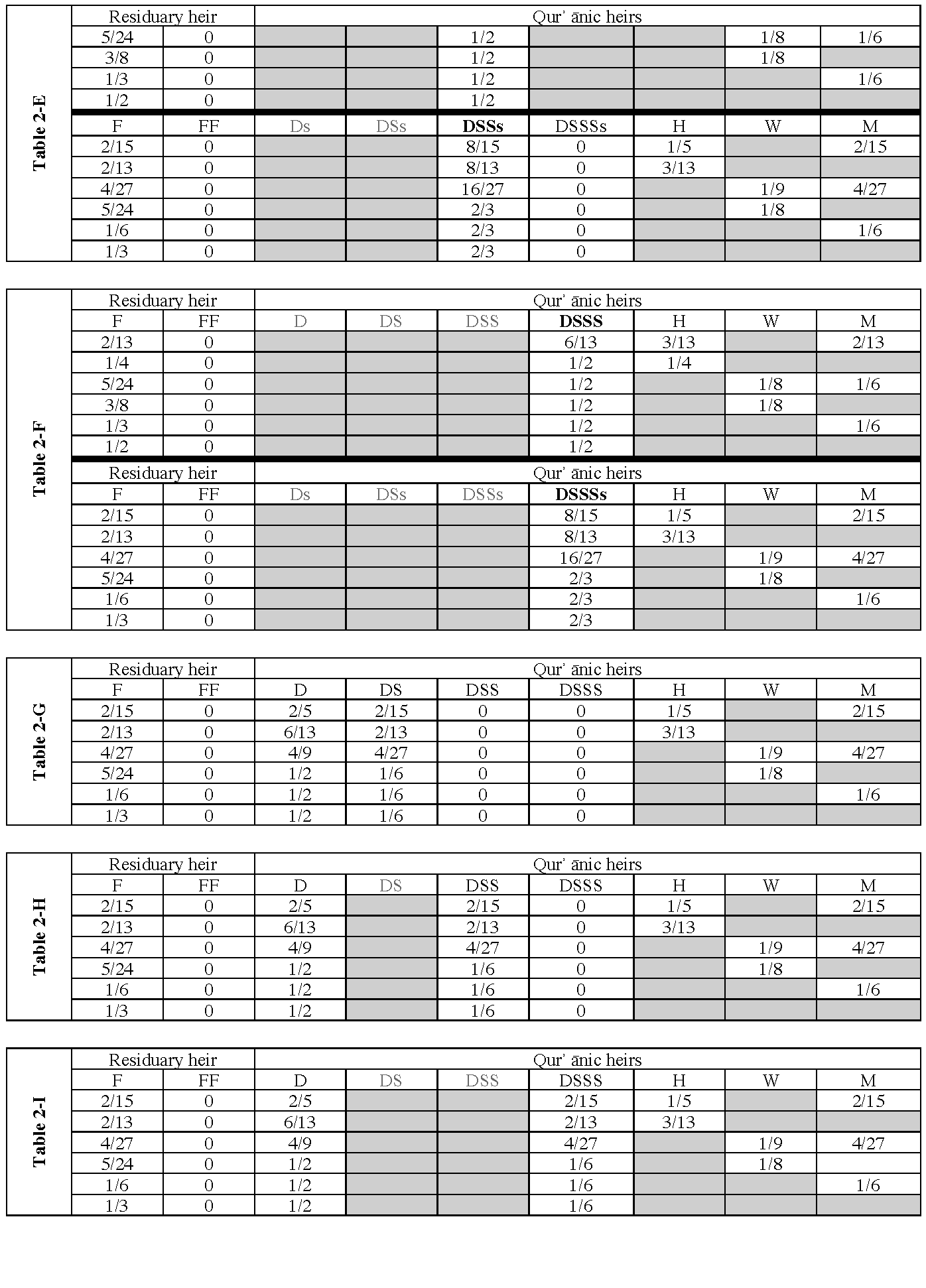

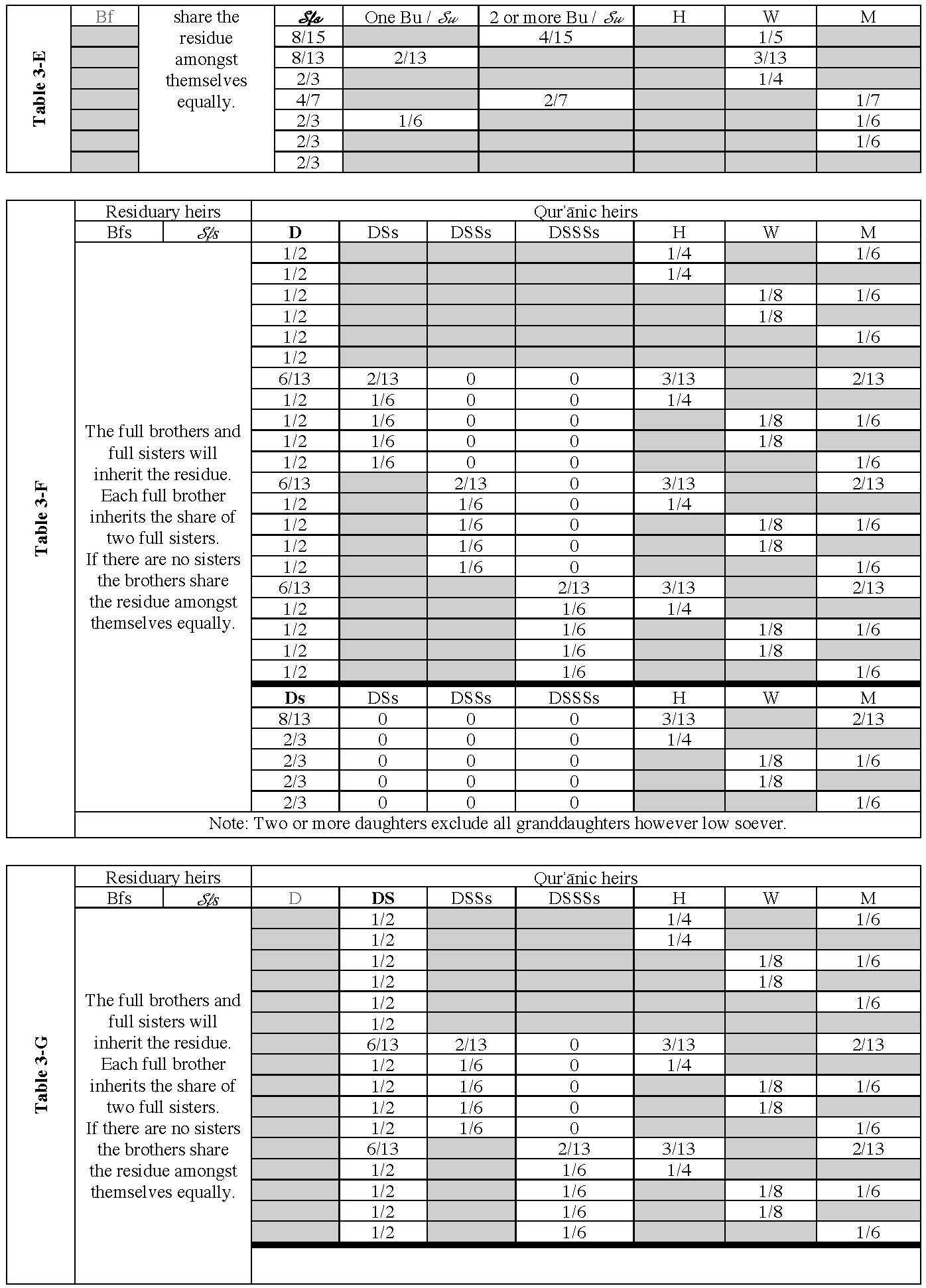

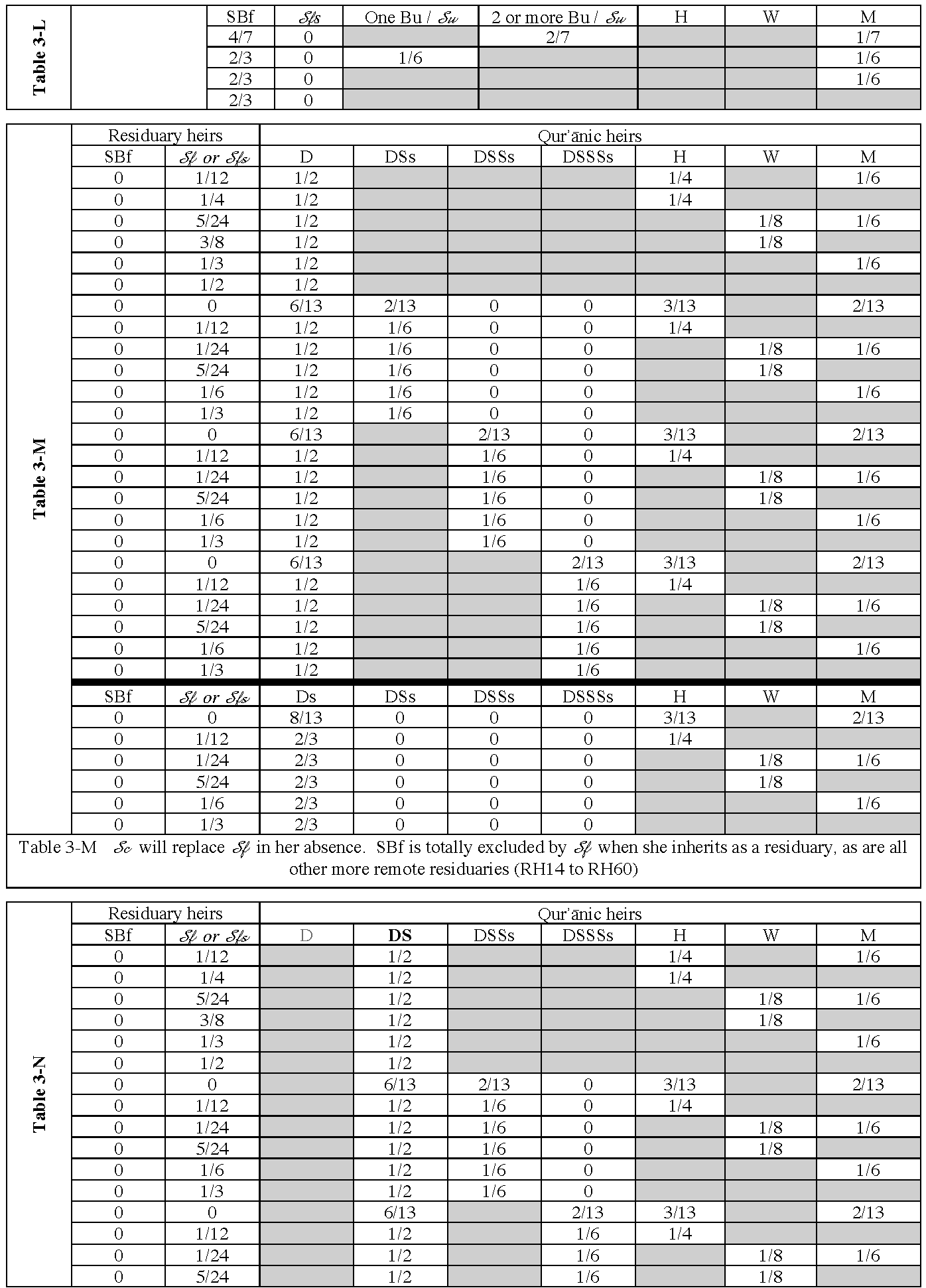

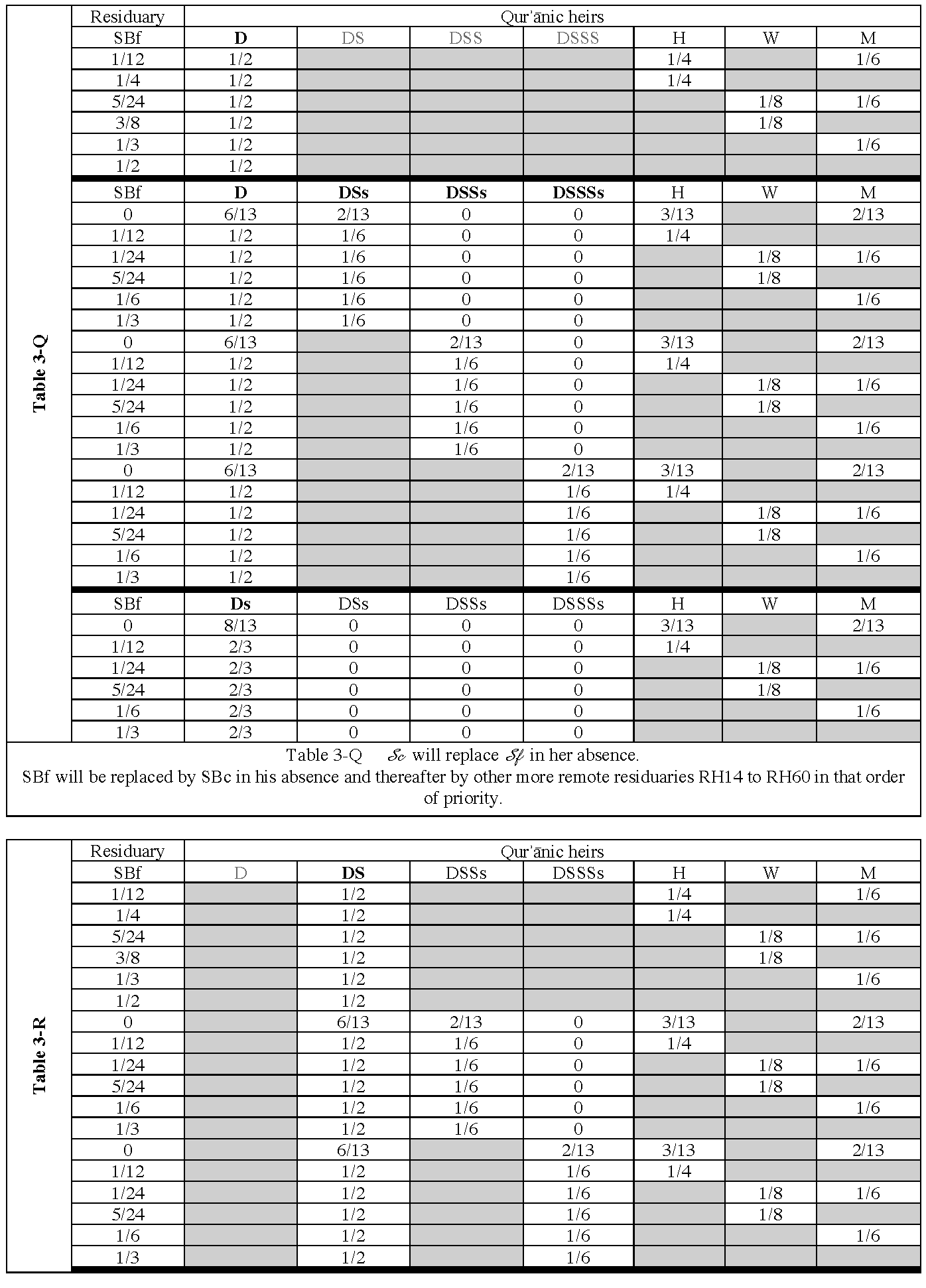

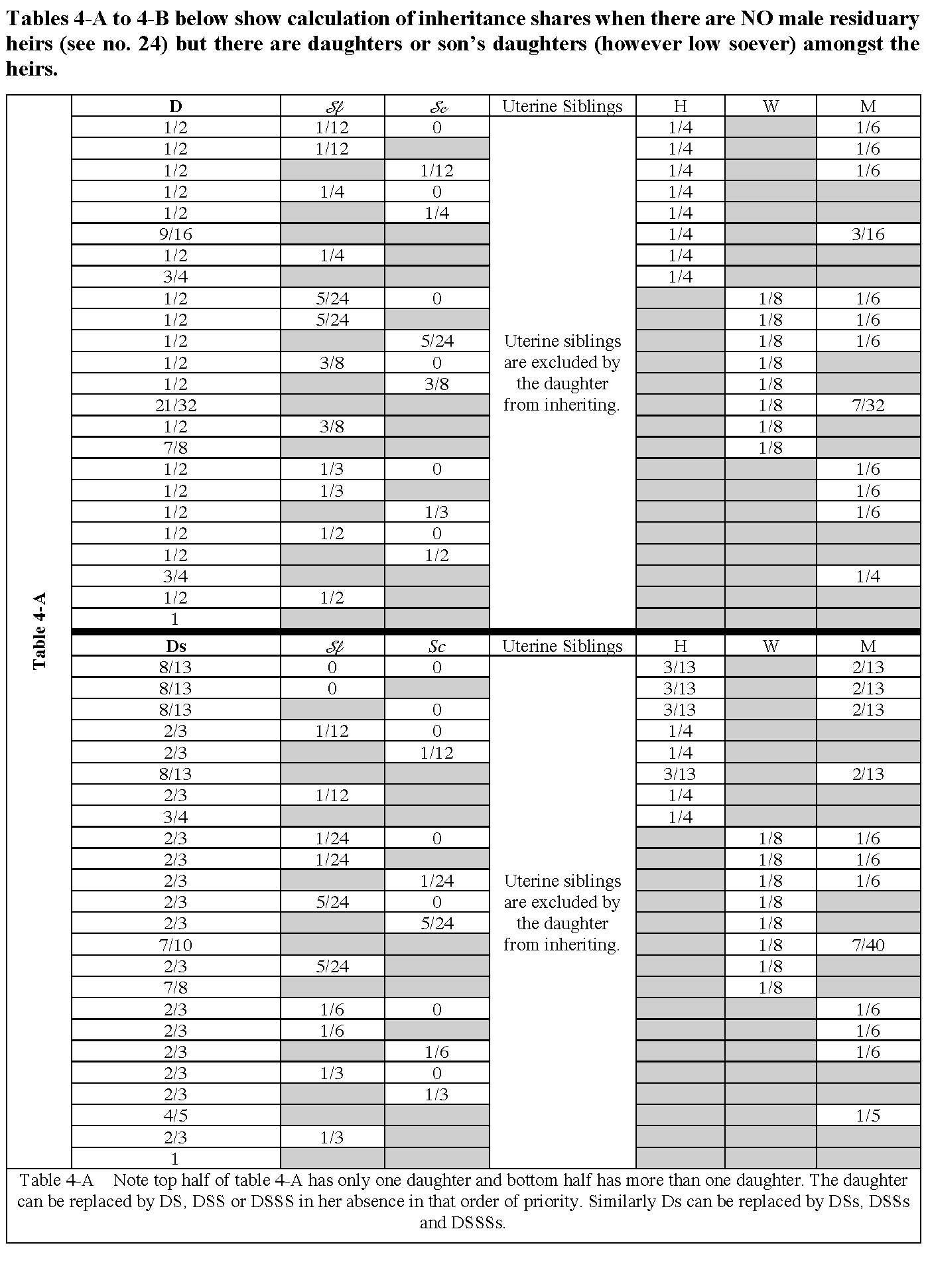

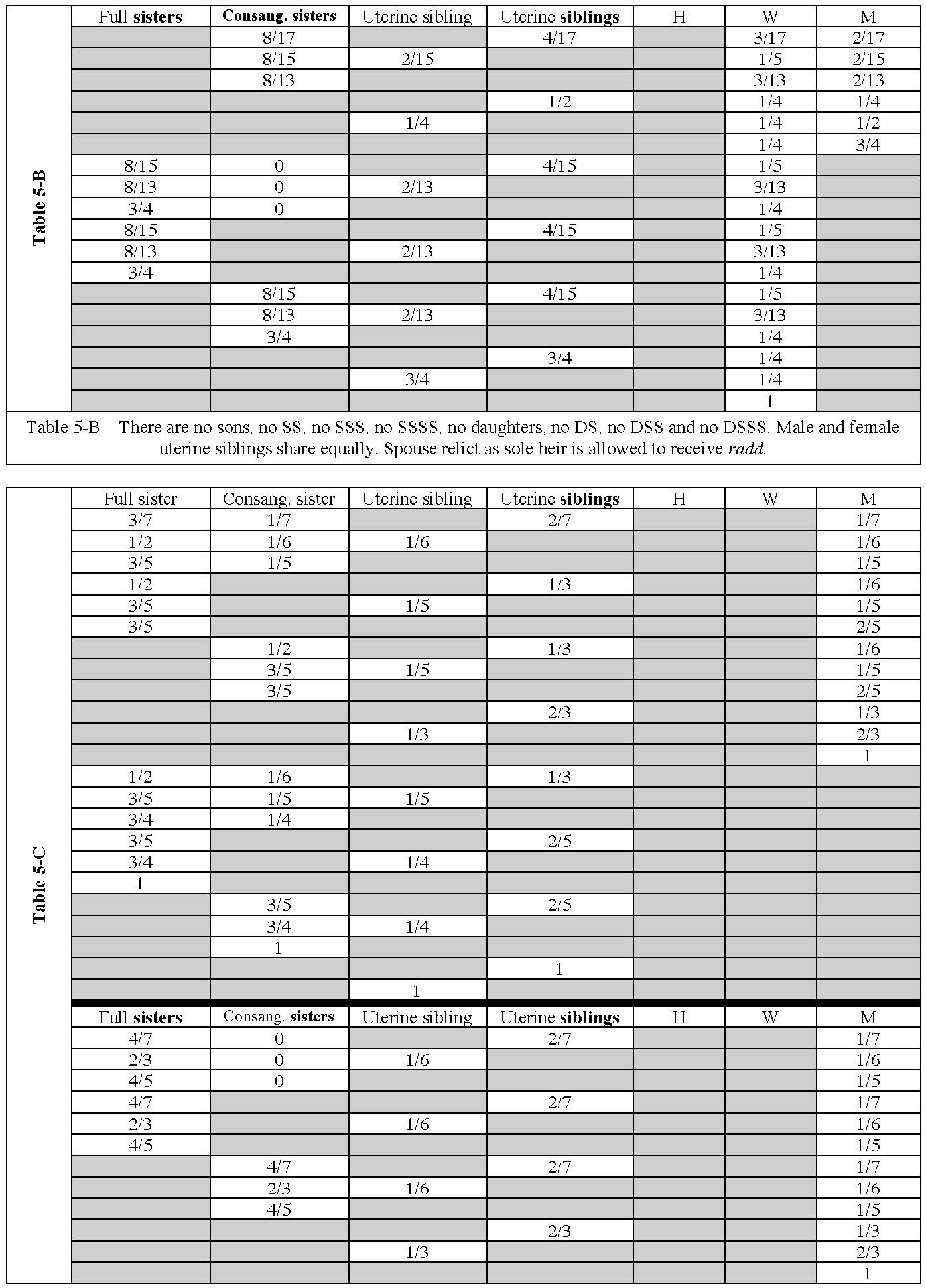

The following Schedule of Inheritance can be incorporated into an Islāmic Will or into a Will trust either directly or via incorporation of a document by reference.

The Schedule removes any uncertainty as to who the legal heirs are according to Islamic law (Ḥanafī fiqh) and what the share is of each heir. By clearly stipulating the shares of each heir, it reduces the likelihood of disputes and disagreements among beneficaries, executors and trustees, streamlining the distribution process.

You can produce a customised free Islāmic Will incorporating this Schedule into your Will online on this website by registering.

A. Hussain, October 2020