بِسۡمِ اللهِ الرَّحۡمٰنِ الرَّحِيۡمِ

One of the most tax-efficient ways of donating money to a UK-registered charity is to donate through Payroll Giving (also called Give as You Earn). For higher rate taxpayers Payroll Giving is the only way the charity of your choice can automatically receive all your tax on your charitable donation and for all taxpayers, Payroll Giving is the most beneficial way to donate your zakāh to a charity with 100% donation policy. For zakāh donations, you must donate to a charity with a 100% donation policy to ensure your zakāh obligation is fulfilled.

How does it work?

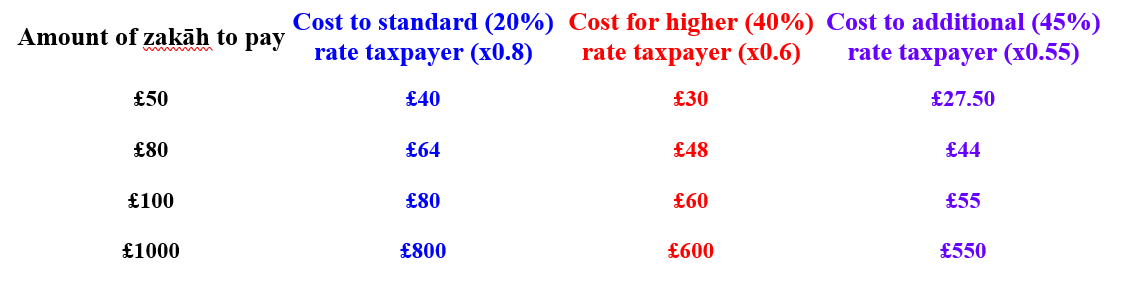

Any donation(s) you make to a UK-registered charity is taken from your salary after your national insurance contributions but before income tax is calculated and deducted. For the donor, this has considerable financial benefits and for the charity, it takes out the administrative hassle of having to claim Gift Aid. Under normal circumstances, if a donor wishes to give £1000 in donation (e.g. zakāh) then as a standard rate taxpayer (20% rate tax) he (or she) must have earned £1250, after deduction of NI contributions, to receive a net income of £1000 which he (or she) donates as zakāh to a charity which will pass on this money to those eligible to receive zakāh. For a higher rate taxpayer (40% rate tax), he (or she) must have earned £1666.67, after deduction of NI contributions, to receive a net income of £1000. However, if the zakāh payer donates through Payroll Giving he (or she) needs only to earn £1000, after the deduction of NI contributions, to pay zakāh of £1000. The standard rate taxpayer saves £250 and the higher rate taxpayer saves £666.67. Another way to look at it is that to pay £1000 of net income in zakāh costs the standard taxpayer only £800 and the higher taxpayer only £600 if paid through Payroll Giving. The national insurance contributions are not affected as these are taken before any charitable donations are made. The table below summarises the financial benefits.

Which Charities Can Receive Such Donations

Any UK, EU, Norwegian or Icelandic charity that is recognised by HMRC for tax purposes can receive gifts this way.

How is Payroll Giving Different from Gift Aid

When you make a direct donation to a charity and you tick the box that allows the charity to apply for Gift Aid on your donation, then the charity claims back the 20% income tax you have paid to HMRC on your donation, this works out to be £25 on every £100 you donate, i.e. 25%. The charity does have to go through the hassle and administrative procedure of claiming the Gift Aid, many charities employ a third party to claim Gift Aid on their behalf. If you donate through Payroll Giving you get the tax benefit and the charity does not have the administrative hassle of claiming Gift Aid.

Benefits to the Donor

Donating through Payroll Giving is particularly beneficial to higher-rate taxpayers with large zakāh donations. Of course, one must ensure the charity being donated to has a 100% donation policy for zakāh.

How to go About Donating Through Payroll Giving

Firstly, you need to contact your payroll/ HR department to check if your employer offers Payroll Giving. If your employer does then complete a mandate form which is usually obtained from the payroll/ HR department or the Payroll Giving Agency (PGA) your employer has signed up with. My employer, Central Manchester Foundation Trust, has signed up with STC Payroll Giving (http://www.stcpayrollgiving.co.uk/index/). The form will ask you to give the name(s) of the charity(ies) you wish to make a donation to and the amount you wish to donate.

Does my Employer Need to Know Which Charity I Support?

No. Once you have completed the mandate form this can be sent directly to the Payroll Giving Agency (PGA). The PGA will inform your employer how much money you wish to donate and what needs to be deducted from your salary. Alternatively, you could ask for a Charity chequebook or Vouchers so that you can give directly to the charities of your choice. Most PGAs offer this service; a minimum amount of donation is usually necessary.

Are There Any Costs Involved?

The Payroll Giving Agency (PGA) do charge a fee which they deduct from the donation before distributing to your nominated charity. These fees vary. For instance, STC Payroll Giving charges …., while Charity Aid Foundation charges a whooping 4%. Many employers pay the PGA fees so that your full donation reaches your nominated charity(ies).

How do you Know Your Donation has Reached Your Charity?

You can tick a box on the mandate form that you wish to receive an acknowledgement from your nominated charity(ies) upon receipt of your donation.

Can my Donation be Refunded?

No. Once your donation has been deducted from your pre-tax income it must go to a charity. If you have put down a charity which is not recognised by HMRC as being able to receive Payroll Giving the PGA will forward your donation to a charity which has similar aims to the one you nominated. They will let you know that this is what has happened and this gives you the opportunity to amend your form and select another charity.