بِسۡمِ اللهِ الرَّحۡمٰنِ الرَّحِيۡمِ

This is a proposal for local Muslim burial councils, Councils of Masaajid, and individual Masaajid to consider establishing an "Inheritance Debt Resolution Committee" to facilitate the expeditious settlement of debts owed by deceased individuals. The proposed Committee would address several key issues in the current process of debt resolution in Muslim communities.

Please note this is a draft proposal. Any constructive comments or suggestions are welcome via the website or via email to ahussain1999@doctors.org.uk

Introduction

Debt in Islam is not merely a financial obligation but a profound moral responsibility. The Prophet Muhammad (![]() ) informed us that, “The soul of a believer remains suspended until their debt is settled” (Tirmidhi, Book 7, Hadith 49) and he (

) informed us that, “The soul of a believer remains suspended until their debt is settled” (Tirmidhi, Book 7, Hadith 49) and he (![]() ) said, “In matters of debt. By Him in whose hand Muhammad’s soul is, if a man were to be killed in God’s path then come to life, be killed again in God’s path then come to life, and be killed once more in God’s path then come to life owing a debt, he would not enter paradise till his debt was paid.” (Ahmad transmitted it, Mishkat al-Masabih 2929). This spiritual urgency underscores the Islamic mandate to resolve debts promptly, ensuring the deceased’s peaceful transition to the Hereafter. The Quran further mandates documentation of debts: “When you contract a loan for a fixed period, commit it to writing” (Quran 2:282), establishing transparency as a divine principle.

) said, “In matters of debt. By Him in whose hand Muhammad’s soul is, if a man were to be killed in God’s path then come to life, be killed again in God’s path then come to life, and be killed once more in God’s path then come to life owing a debt, he would not enter paradise till his debt was paid.” (Ahmad transmitted it, Mishkat al-Masabih 2929). This spiritual urgency underscores the Islamic mandate to resolve debts promptly, ensuring the deceased’s peaceful transition to the Hereafter. The Quran further mandates documentation of debts: “When you contract a loan for a fixed period, commit it to writing” (Quran 2:282), establishing transparency as a divine principle.

Inheritance debt refers to debts left behind by a deceased person that must be settled from their estate before the remaining assets can be distributed to heirs. In Islamic law, settling the debts of the deceased is considered a critical obligation that takes precedence over distributing inheritance.

Establishing a local Inheritance Debt Resolution Committee (IDRC) aligns with these teachings, offering a structured mechanism to address unresolved debts. By centralising efforts under Islamic institutions, the IDRC would uphold communal accountability, mitigate familial disputes, and fulfil the Quranic injunction to “cooperate in righteousness and piety” (Quran 5:2).

Scope and Importance of the Problem

Over 56% of UK adults die without a valid will, complicating inheritance distribution. Within Muslim communities, informal lending practices exacerbate this issue: many transactions lack written documentation, contravening Quranic directives. Undocumented debts leave families unaware of liabilities, risking violations of Islamic inheritance laws (Quran 4:11–12).

The consequences are severe. Creditors face uncertainty, while heirs risk inheriting unresolved liabilities. The Prophet (![]() ) emphasised communal responsibility, refusing to pray over a debtor until a companion settled the debt (Musnad Ahmad 3/629). Without a systematic resolution, the deceased’s soul remains in spiritual limbo, and families endure prolonged financial and emotional strain.

) emphasised communal responsibility, refusing to pray over a debtor until a companion settled the debt (Musnad Ahmad 3/629). Without a systematic resolution, the deceased’s soul remains in spiritual limbo, and families endure prolonged financial and emotional strain.

Proposal to Tackle the Problem

A proposal s made in this paper to establish local Inheritance Debt Resolution Committees (IDRC) under the auspices of the local Council of Masasjid in collaboration with local Muslim Burial Council (local MBC) and local imams. This collaborative initiative would try to ensure the debts of all locally deceased Muslims is settled expeditiously while being deeply rooted in community structures and religious authority, enhancing its credibility and reach.

The IDRC's primary objectives would be threefold, each addressing a critical aspect of Islamic financial ethics and inheritance practices. Firstly, the Committee would spearhead efforts to encourage Muslims to formalise their debts through written contracts. This documentation drive aligns with Quranic injunctions to record financial transactions, as stated in Surah Al-Baqarah (2:282), promoting transparency and reducing potential disputes.

Secondly, the IDRC will focus on educational initiatives, organising workshops and seminars to promote understanding of Islamic inheritance laws and the importance of writing an Islamic Will which is valid under English law. These educational efforts aim to address the alarming statistic that over 56% of UK adults die intestate, a figure potentially higher among Muslim communities due to misconceptions about Sharia compliance in UK inheritance laws.

Thirdly, the committee could serve a mediatory role, acting as an intermediary between creditors and bereaved families. This function is particularly vital in navigating the sensitive period following a death, ensuring that debt claims are handled with both Islamic principles of justice and compassion in mind.

To amplify these objectives, local imams play a pivotal role. By leveraging their moral authority and community influence, imams can integrate IDRC advocacy into their sermons and teachings. This integration allows for the reinforcement of Islamic financial ethics within a spiritual context. Imams can emphasise examples and teachings of the Prophet Muhammad (![]() ) that underscore the importance of debt repayment and financial integrity. For instance, they might quote the hadith from Sahih al-Bukhari (43:6) where the Prophet Muhammad (

) that underscore the importance of debt repayment and financial integrity. For instance, they might quote the hadith from Sahih al-Bukhari (43:6) where the Prophet Muhammad (![]() ) stated, "The best among you are those who repay debts handsomely." This teaching not only encourages prompt debt settlement but also promotes generosity and ethical conduct in financial dealings.

) stated, "The best among you are those who repay debts handsomely." This teaching not only encourages prompt debt settlement but also promotes generosity and ethical conduct in financial dealings.

By operating under this framework, the IDRC can effectively address the complex issues surrounding inheritance and debt in Muslim communities, promoting financial responsibility, ethical practices, and adherence to Islamic principles.

Framework for the Project

1. Educational Groundwork

The successful implementation of the IDRC hinges on robust community education rooted in Islamic principles. Central to this effort is the teachings of Islam about debt ethics in the masaajid especially at Friday khutab, where imams can elucidate Quranic injunctions such as “If someone is in hardship, postpone repayment until ease” (Quran 2:280). Such khutab can serve as a moral compass, reinforcing the spiritual consequences of unresolved debts—such as the Prophet’s (![]() ) refusal to pray over-indebted individuals until obligations were met . By contextualizing debt resolution within Islamic teachings, imams can inspire congregants to prioritise ethical financial practices and document transactions, aligning with Quranic directives to “commit loans to writing” (Quran 2:282).

) refusal to pray over-indebted individuals until obligations were met . By contextualizing debt resolution within Islamic teachings, imams can inspire congregants to prioritise ethical financial practices and document transactions, aligning with Quranic directives to “commit loans to writing” (Quran 2:282).

Complementing this, workshops led by appropriate experts can demystify Islamic inheritance laws and debt documentation. Such community events would train participants in drafting Sharia-compliant wills and recording debts through written contracts. Practical modules might include case studies on estate management and role-playing exercises to navigate familial disputes, ensuring heirs understand their duty to settle debts from the deceased’s estate. Such initiatives address the alarming statistic that 56% of UK Muslims lack wills, mitigating risks of intestacy and unresolved liabilities.

2. Collaborative Infrastructure

A unified approach between Islamic institutions is critical. The local Council of Masaajid should issue standardized guidelines for debt resolution, including templates for loan agreements and protocols for mediating disputes. By coordinating with local masaajid, the Council can ensure consistency in messaging, such as distributing multilingual resources on inheritance planning and hosting quarterly seminars on financial literacy emphasising transparency and communal trust .

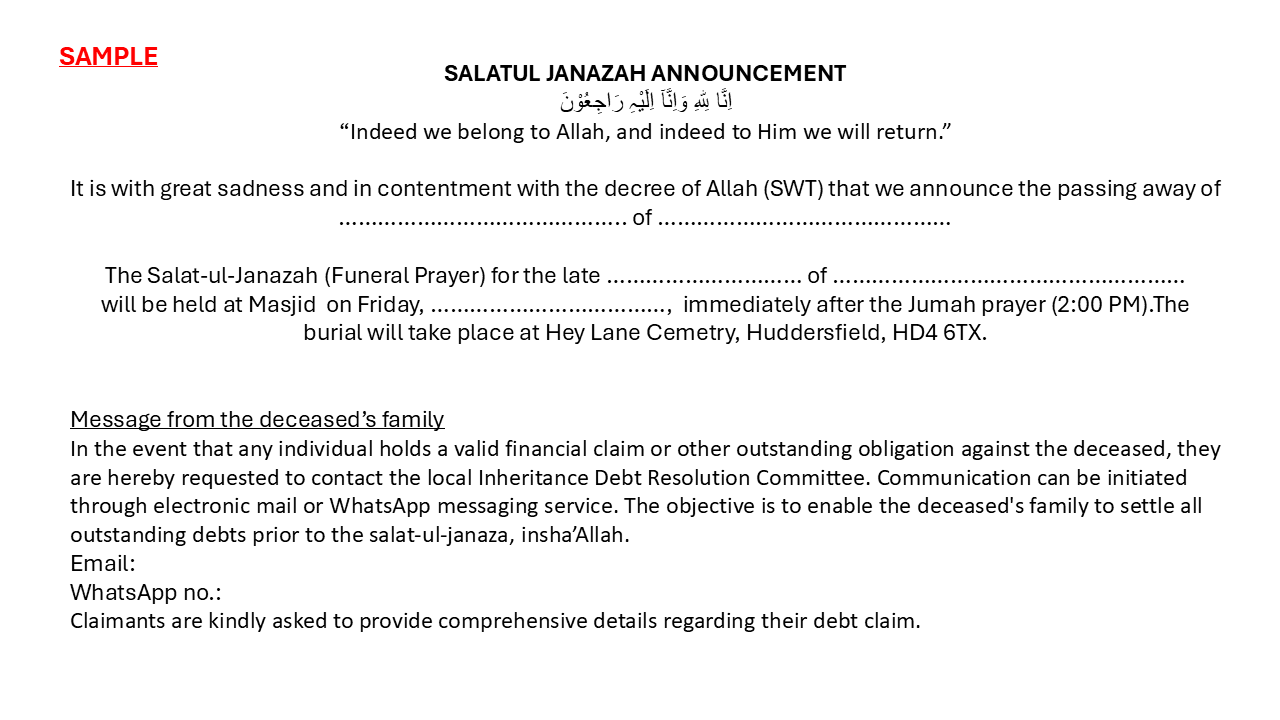

Simultaneously, the local Muslim Burial Council (local MBC) will need to integrate IDRC protocols into burial processes. Upon notification of a death, the local MBC would sensitively enquire if families wish to include a debt claim clause in the death and janaza prayer announcement, allowing creditors to come forward. Validated claims can then be prioritised ideally before burial rites, adhering to the Prophet’s (![]() ) emphasis on resolving debts promptly to free the deceased’s soul. In cases where estates are insufficient, the local IDRC could collaborate with any local or national zakat charities to explore Sharia-compliant solutions, such as voluntary repayment by heirs or creditor forgiveness .

) emphasis on resolving debts promptly to free the deceased’s soul. In cases where estates are insufficient, the local IDRC could collaborate with any local or national zakat charities to explore Sharia-compliant solutions, such as voluntary repayment by heirs or creditor forgiveness .

By intertwining education with institutional cooperation, the IDRC fosters a culture of accountability, ensuring debts are settled with dignity and aligning communal practices with Quranic justice.

Implementation of the Project

The local Muslim Burial Council (local MBC) would need to play a pivotal role in initiating the debt resolution process. Upon notification of a death, the local MBC sensitively inquires whether the family wishes to include an optional debt claim clause in public death announcements. This clause allows creditors to come forward while respecting the bereaved family’s privacy and emotional state. By framing this step as voluntary, the local MBC upholds Islamic principles of compassion and avoids adding undue stress during a period of grief.

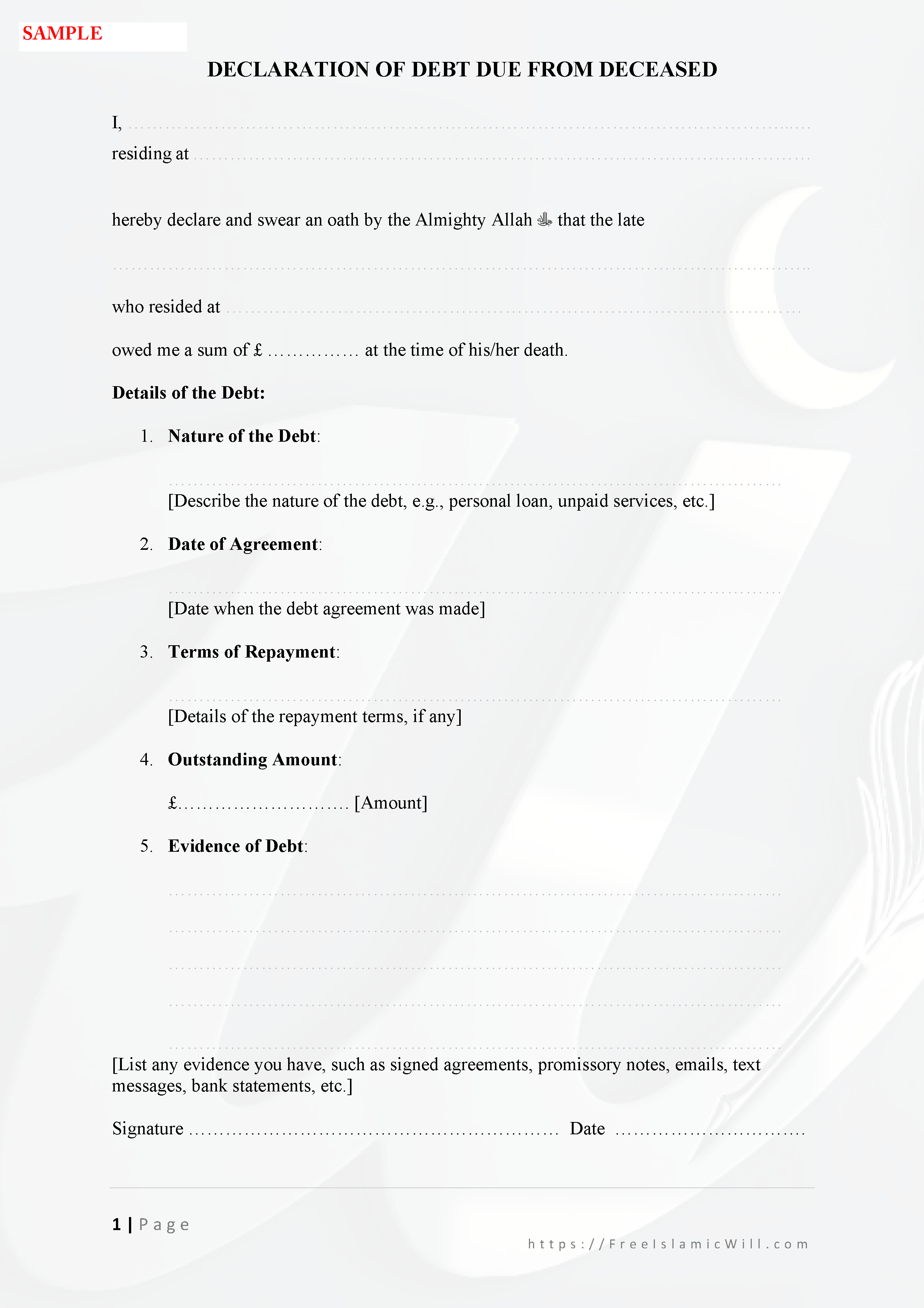

Once the announcement is disseminated, creditors are directed to submit claims through standardized IDRC forms, which require detailed evidence such as written contracts, witness statements, or transaction records. This formal process ensures accountability and reduces disputes, aligning with the Quranic mandate to “reduce debts to writing” (Quran 2:282). The IDRC reviews each claim meticulously, verifying its authenticity against submitted documentation before proceeding.

Following validation, the IDRC would notify the deceased’s family of all verified claims, providing a transparent summary of outstanding debts. This step ensures heirs are fully informed of their obligations under Islamic inheritance laws, which prioritise debt settlement before asset distribution (Quran 4:11–12). Clear communication fosters trust and encourages prompt resolution, minimising the risk of unresolved liabilities affecting the deceased’s spiritual status.

As the system evolves, the IDRC may expand its services to include mediation or arbitration, modelled on established conflict-resolution frameworks. Trained mediators would facilitate negotiations between creditors and families, aiming for equitable solutions such as extended repayment timelines or partial debt forgiveness. This phased approach not only addresses immediate concerns but also cultivates a culture of ethical financial conduct within the community, reinforcing the Prophetic teaching to “relieve the debtor with ease” (Sahih al-Bukhari 2397).

The final goal should be to establish a system within the community so that the debts of a deceased can be paid by a community fund (analogous to a bayt-ul-mal). This was the practice of the Prophet Muhammad (![]() ) when he was in a position to do so.

) when he was in a position to do so.

The Role of Zakat Funds in Settling Debts

The use of zakat to settle a deceased Muslim’s debts is governed by nuanced juristic principles, with rulings varying across Islamic schools of thought. Under Maliki and Shafi’i jurisprudence, zakat may be allocated to clear debts if the deceased was eligible for zakat during their lifetime and the debt was incurred for lawful purposes. These schools interpret Quranic injunctions broadly, emphasising communal welfare (maslaha) and the Quranic directive to aid “those in debt” (Quran 9:60). For instance, Imam al-Dardir of the Maliki school affirmed that zakat could discharge a deceased’s lawful debt if the estate is insufficient.

Conversely, the Hanafi and Hanbali schools restrict zakat disbursement to living recipients, arguing that posthumous debt relief does not directly benefit the deceased, who no longer bears worldly obligations. However, they permit voluntary repayment by heirs or third parties as an act of charity (sadaqah), reflecting the Prophetic teaching: “Whoever relieves a believer’s distress, Allāh (![]() ) will relieve theirs on the Day of Resurrection” (Sahih Muslim 2699).

) will relieve theirs on the Day of Resurrection” (Sahih Muslim 2699).

IDRC could establish a zakat subcommittee to assess eligibility. This body would verify whether the deceased met zakat criteria and mediate between creditors and heirs. Scholars like Ibn Qudamah, a prominent Hanbali jurist, endorsed such communal efforts, noting that debt relief aligns with Islam’s emphasis on collective responsibility and social harmony. By integrating these principles, the IDRC ensures adherence to Sharia while addressing the ethical imperative to safeguard the deceased’s spiritual and financial legacy.

Some FAQs related to using zakat funds to pay debts of the deceased.

Q. If Zakat requires transferring ownership to a living recipient (tamleek), how can it be used for someone who has passed away?

A. The scholars (Malaki and some Shafi’i) who consider it permissible to use zakat funds argue that paying off the debt benefits the living creditors. In essence, the zakat is not given to the deceased, but for the release of his obligations, which in turn benefits those who are alive and owed the money.

It's crucial that the deceased was eligible to receive zakat at the time of his/ her death. There are absolutely no assets in the estate to cover the debt, and the heirs are unable to pay the debt of the deceased. Some scholars further stipulate that the creditors themselves must also be eligible to receive zakat. Using zakat funds for its purpose is the last resort.

The donor of zakat funds must have the intention of relieving the hardship of the deceased and to benefit the living creditors.

Conclusion

Unresolved debts jeopardise spiritual and familial harmony, violating Islamic principles of justice. The establishment of a local IDRC offers a faith-compliant solution, uniting masaajid, burial councils, and scholars to uphold Quranic mandates. By prioritising documentation, education, and mediation, the IDRC would try to ensure debts are settled with dignity.

Implementing this proposal requires sustained collaboration, but its success would affirm the Muslim community’s commitment to financial integrity and divine accountability. As the Prophet (![]() ) taught us, “Relieve the debtor, and Allāh (

) taught us, “Relieve the debtor, and Allāh (![]() ) will relieve you in this world and the next” (Sahih Muslim 2699).

) will relieve you in this world and the next” (Sahih Muslim 2699).

Dr. A. Hussain Feb. 2025

----------------------------------------------

Sources and Information for Preparing Khutab

Khuthba on Debt

اَلْحَمْدُلِلّٰهِ نَحْمَدُهُ وَنَسْتَعِيْنُهُ وَنَسْتَغْفِرُهُ وَنُؤْمِنُ بِهِ وَنَتَوَكَّلُ عَلَيْهِوَنَعُوْذُ بِاللّٰهِ مِنْ شُرُوْرِأَنْفُسِنَا وَمِنْ سَيِّئَاتِ أَعْمَالِنَامَنْ يَهْدِهِ اللّٰهُ فَلاَمُضِلَّ لَهُ وَمَنْ يُضْلِلْهُفَلاَ هَادِيَ لَهُ وَأَشْهَدُأَنْ لاَّ إِلٰهَ إِلاَّاللّٰهُ وَحْدَهُ لاَ شَرِيْكَلَهُ وَأَشْهَدُ أَنَّ مُحَمَّدًا عَبْدُهُوَرَسُوْلُهُ

أَمَّا بَعْدُ

O Believers! I exhort you and myself to have taqwa of Allah, for indeed, the righteous are the successful.

Brothers and Sisters in Islam,

Today, I want to address a matter of great importance in our lives: debt in Islam. We live in a world where debt is often normalized and even encouraged. However, as Muslims, we must approach this issue with the guidance of the Quran and the Sunnah. Remember, our primary objective is to avoid the Hellfire and to assist others in avoiding the Hellfire. Striving for fairness, justice, and conducting our lives according to the Divine Will is how we achieve this goal.

My brothers and sisters, the perils of debt I am about to tell you about debt, is not to frighten you, but to arm you. Not to instil despair, but to ignite a fire within you - a fire of awareness, a fire of responsibility. Because our beloved Prophet Muhammad (صلى الله عليه وسلم), cautioned us, saying:

إِنَّ لِكُلِّ أُمَّةٍ فِتْنَةً وَفِتْنَةُ أُمَّتِي الْمَالُ

“Indeed there is a fitnah (meaning trial) for every Ummah, and the fitnah for my Ummah is wealth."_

Every nation has its trials, the Prophet (صلى الله عليه وسلم) warned us. And for our community, for the Ummah of the Prophet Muhammad (صلى الله عليه وسلم), that trial lies in wealth. So let us not fall pray, let us not be seduced by the allure of easy credit and material excess. Let us instead strive for balance, for contentment, and for a life of financial integrity, so that we may meet Allah with a clear conscience, and a heart free from the shackles of debt.

Islām is a comprehensive religion offering guidance on various life aspects, including the ethics of debt. Debt involves lending wealth to be returned at an agreed time. Helping others through lending is virtuous, as the Prophet Muhammad (صلىالله عليه وسلم) stated that aiding someone in difficulty leads to Allāh alleviating our difficulties in the afterlife. Allāh in the Quran, surah Maidah ayah no. 2 emphasises cooperation in goodness and righteousness:

وَتَعَاوَنُوا۟عَلَى ٱلْبِرِّ وَٱلتَّقْوَىٰ ۖوَلَا تَعَاوَنُوا۟ عَلَى ٱلْإِثْمِ وَٱلْعُدْوَٰنِۚ وَٱتَّقُوا۟ ٱللَّهَۖ إِنَّ ٱللَّهَشَدِيدُ ٱلْعِقَابِ

"Help one another in righteousness and piety, but do not help one another in sin and aggression. And fear Allah. Indeed, Allah is severe in punishment." (Quran 5:2)

Let us pause for a moment to consider the ethical principles Islām teaches us about taking on debt:

Firstly, a Muslim must have sincere intention. When giving a loan, do so with the sincere intention of helping someone in need, without exploiting their vulnerability. The Prophet Muhammad (صلى اللهعليه وسلم) said, "He who alleviates the suffering of a brother out of the sufferings of the world, Allah would alleviate his suffering from the sufferings of the Day of Resurrection, and he who finds relief for one who is hard-pressed, Allah would make things easy for him in the Hereafter, and he who conceals (the faults) of a Muslim, Allah would conceal his faults in the world and in the Hereafter." This hadith is recorded in Sahih Muslim, hadith no. 2699.

Secondly, if you are owed money, collect it with respect and kindness. Be willing to offer extensions if the person is struggling to repay. The Messenger of Allah (صلىالله عليه وسلم) said: "May Allāh's mercy be on him who is lenient in his buying, selling, and in demanding back his money." This hadith is recorded in Sahih al_Bukhari, hadith no. 2076).

Thirdly, Allah (سُبْحَانَهُوَتَعَالَى) tells us in the Quran in surah Baqara ayah no. 282 to record all debts with witnesses to avoid misunderstandings later on. He says:

يَـٰٓأَيُّهَا ٱلَّذِينَ ءَامَنُوٓا۟ إِذَا تَدَايَنتُم بِدَيْنٍ إِلَىٰٓ أَجَلٍۢ مُّسَمًّۭى فَٱكْتُبُوهُ ۚ وَلْيَكْتُب بَّيْنَكُمْ كَاتِبٌۢ بِٱلْعَدْلِ ۚ وَلَا يَأْبَ كَاتِبٌ أَن يَكْتُبَ كَمَا عَلَّمَهُ ٱللَّهُ ۚ فَلْيَكْتُبْ وَلْيُمْلِلِ ٱلَّذِى عَلَيْهِ ٱلْحَقُّ وَلْيَتَّقِ ٱللَّهَ رَبَّهُۥ وَلَا يَبْخَسْ مِنْهُ شَيْـًۭٔا ۚ ۖ

O you who have believed, when you contract a debt for a specified term, write it down. And let a scribe write [it] between you in justice. Let no scribe refuse to write as Allah has taught him. So let him write and let the one who has the obligation dictate. And let him fear Allah, his Lord, and not leave anything out of it.

Fourthly, Muslims should strive to avoid unnecessary debt. The Prophet (صلى الله عليه وسلم) used to make du’a against being in debt, because it can lead to lying and breaking promises: Allāh's Messenger (صلىالله عليه وسلم) used to invoke Allāh in the prayer saying, "O Allāh, I seek refuge with you from all sins, and from being in debt." Someone said, O Allāh's Messenger (صلىالله عليه وسلم)! (I see you) very often you seek refuge with Allāh from being in debt. He replied, "If a person is in debt, he tells lies when he speaks, and breaks his promises when he promises." This hadith is recorded in sahih al-Bukhari, hadith no. 2397

Fifthly, if you do take on debt make it a priority to repay it on time. Abu Hurairah RA narrated that the Messenger of Allāh (صلى الله عليهوسلم) said: “The best of you - or among the best of you - are those who pay off their debts in the best manner.”

Point 6 is to understand that failing to repay your debts has serious consequences, not only in this life but also in the Hereafter. The Prophet (صلى الله عليه وسلم) warned: “Whoever dies owing a Dinar or a Dirham, it will be paid back from his good deeds, because then there will be no Dinar or Dirham.” This hadith is recorded by Ibn Majah, hadith no. 2414.

Brothers and Sisters in Islam, let us reflect on the severity of the matter. The Prophet (صلىالله عليه وسلم) showed great concern for those who died with unpaid debts. He صلى الله عليه وسلم) said: “In matters of debt. By Him in whose hand Muhammad’s soul is, if a man were to be killed in God’s path then come to life, be killed again in God’s path then come to life, and be killed once more in God’s path then come to life owing a debt, he would not enter paradise till his debt was paid.” This hadith has been transmitted by Imam Ahmad and recorded in Mishkat al-Masabih, hadith no 2929. The Messenger of Allāh (صلىالله عليه وسلم) also said, “All the sins of a shahīd (martyr) are forgiven except debt” as recorded by in Sahih Muslim, hadith no. 1886a, and that, “A believer’s soul remains in suspense until all his debts are paid off.” (Amhad, Tirmidhī and Ibn Mājah)

Also think of the reluctance shown by the Prophet (صلى الله عليهوسلم) of leading the funeral prayer of a person who had unpaid debts.

Khuthba on Importance of Inheritance Law

To be completed

Khuthba on Islamic Wills

To be completed