بِسۡمِ اللهِ الرَّحۡمٰنِ الرَّحِيۡمِ

This article is for educational purposes and does not constitute any advice.

1.Introduction

2. Money v Currency. Are they the same?

3. Money: Gold v Fiat v Bitcoin

4. Understanding fiat money

5. The problem with fiat money from an Islamic perspective

6. The problem with fractional reserve banking

7. Is a return to the gold standard a feasible option?

8. Gold-backed crypto-currencies - Is this the solution?

9. The advent of Bitcoin: A solution, an alternative or neither?

10. Is Bitcoin halāl or harām?

12. Arguments in favour of declaring Bitcoin to be harām / impermissible

12. Counter-arguments against the impermissibility of Bitcoin

13. Bitcoin as a Potential Reserve Asset

14. Succession of Crypto-assets: Challenges and Solutions

_______________________________________________________________

1.Introduction

The Qur'ān emphasises fair and just use of wealth among believers (Qur'ān 4:29). It encourages trade by mutual consent but prohibits unjust consumption. Additionally, the Sharīʿa underscores responsible wealth management to prevent waste or extravagance (Qur'ān 7:31). The Prophet Muhammad (![]() ) further encouraged earning through honest labour, highlighting the value of self-earned sustenance.

) further encouraged earning through honest labour, highlighting the value of self-earned sustenance.

It's important to note that only assets deemed halāl and capable of being owned according to Sharīʿa form part of the estate of the deceased and subsequently are inherited. Wealth acquired by illegal means must be given back to the original owners where possible or otherwise given in charity for the benefit of the real owners.

In the contemporary milieu of heightened Islamophobia and sanctions, which may progress to targeting of Muslim individuals and Islamic countries through measures such as the closure of bank accounts, the freezing of assets and trade sanctions, some Muslims view the adoption of Bitcoin presenting itself as a viable alternative for the preservation and transfer of wealth.

Moreover, the portability of Bitcoin stands out as a significant advantage. In situations where Muslims may need to relocate swiftly due to escalating discrimination or threats to their safety, the ability to access and transfer funds internationally without the need for banking infrastructure is invaluable. Bitcoin transactions can be conducted from anywhere in the world, provided there is an internet connection, thus enabling individuals to maintain actual custody of their money across borders without the physical encumbrances of traditional currency.

While some Islamic countries have banned Bitcoin and cryptocurrencies, others such as the UAE encourage crypto adoption with Bitcoin exchanges such as the BitOasis which is also available in Qatar, Kuwait, Bahrain and Saudi Arabia. Pakistan is planning a Bitcoin reservation. The prevalence of past scams within the crypto-asset domain, such as MLM/pyramid schemes like Bitconnect and OneCoin, has inflicted financial harm. Moreover, newer forms of pyramid schemes with aggressive marketing strategies are emerging, complicating the discernment between legitimate opportunities and fraudulent schemes.

2. Money v Currency. Are they the same?

In delineating the distinction between money and currency, it becomes evident that while commonly misconstrued as synonymous, they serve distinct roles within the economic framework. Comprehending this disparity holds profound implications for one's financial strategies and overall fiscal well-being. Regrettably, many individuals abstain from delving into this distinction, often swayed by the purported complexity of the subject, thereby permitting governmental and institutional exploitation of the monetary and financial systems to the detriment of the populace.

The historical bifurcation between money and currency dates back to the dissolution of the Bretton Woods system in 1971, which severed the tie between the US dollar and gold, ushering in the era of fiat currencies. Unlike money, which embodies an abstract concept of value negotiated between transacting parties, currency assumes a tangible form, typically in the guise of notes or coins, serving as a token denoting ownership of money. Traditionally, currency was backed by tangible assets or commodities, thereby infusing it with intrinsic value. However, with the advent of fiat currencies, their worth is now dictated by governmental decree rather than inherent value, rendering them susceptible to inflation and devaluation through unrestricted printing.

The contemporary challenges plaguing the monetary system can be traced back to the pivotal decision undertaken in 1971 to sever the link between the US dollar and the gold standard. This seminal shift engendered a paradigm akin to a Ponzi scheme, characterised by a cyclical pattern perpetuated by the United States' international transactions.

3. Money: Gold v Fiat v Bitcoin

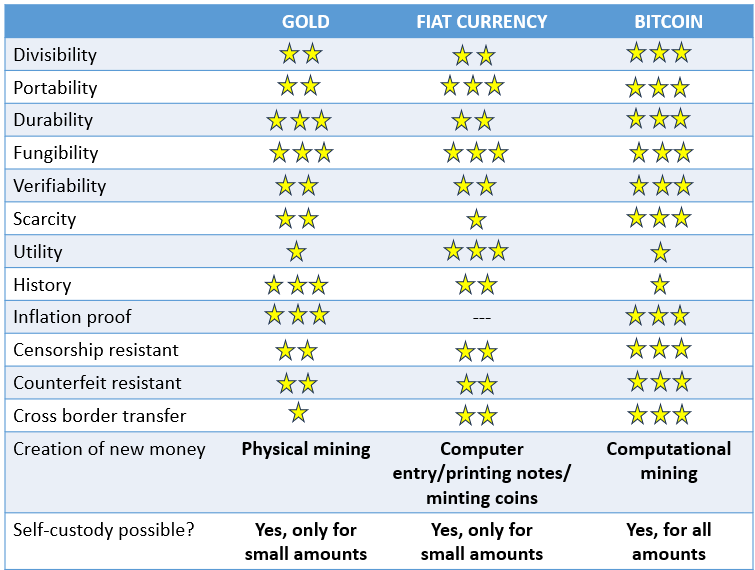

Gold, fiat currencies, and bitcoin can potentially all function as forms of "money" due to their perceived value by individuals, each with distinct advantages and drawbacks. Seven criteria have been delineated which are essential for a medium of exchange:

- Divisibility

- Portability

- Durability

- Fungibility

- Verifiability

- Scarcity

- Utility

Islamic scholars generally define wealth (māl) as a valuable asset that can be exchanged and have permissible benefits according to Sharīʿa. If someone other than the owner damages māl, compensation is required. Additionally, the Ḥanafī school adds features like storability and alignment with human instincts. In modern terms, the following criteria must be met to be considered as māl:

- It should have commercial value.

- It must be capable of ownership and possession.

- It should be storable.

- It must be beneficial according to Sharīʿa.

- Ownership should be assignable and transferable.

Gold and silver are natural forms of money which have been used historically as measures of value. These two metals have intrinsic value. Although gold ostensibly excels as a monetary medium its practicality in contemporary transactions is impeded by logistical challenges, including storage complexities and the necessity for safeguarding and insurance.

Fiat currencies offer unparalleled flexibility and convenience in modern transactions. Nonetheless, they lack intrinsic worth, being unsupported by any underlying commodity, and are instead conjured into existence. Prone to governmental manipulation, fiat currencies are susceptible to inflation, hyperinflation, and eventual devaluation.

4. Understanding fiat money

Government-issued physical money makes up a small fraction, typically 3-8%, of the total money supply, and it isn't asset-backed. The bulk of money creation happens in private banks, accounting for roughly 97% of the money supply in developed nations. While it's illegal for individuals to print money, banks have the legal authority to do so. This raises questions of fairness and justice. When someone borrows money from a bank, say £500,000 for a property, the bank essentially creates digital currency equal to that amount, deposited into the borrower's account as debt. The interest on this debt forms the bank's profit, showing money's dual role as debt. Borrowing, especially for big purchases like homes or cars, contributes to money creation and debt accumulation, impacting the value of existing currency.

Our current financial system intertwines money with debt; loans create deposits, not the other way around. Banks are incentivised to lend, and customers to borrow, fostering a culture of frequent spending and debt reliance. Banks profit significantly from real estate markets and property, which fuel societal dependence on housing-related debt. Additionally, banks leverage deposited funds for investments and speculative ventures, perpetuating debt creation through fractional reserve lending.

Both the UK and the USA have relaxed fractional reserve requirements, enabling banks to create money through lending. Central banks, like the US Federal Reserve, have the power to create money as needed, often by purchasing government bonds. Governments, in turn, accumulate funds through bonds, fuelling a cycle of debt. In international trade, the US pays foreign entities in dollars acquired through borrowing, perpetuating national debt. This cycle, akin to Ponzi schemes, underscores the instability of the current monetary system, evident in the escalating US government debt.

Contemplating the fiat currency paradigm prompts inquiry into its viability, benefiting a select few while susceptible to manipulation and inevitable devaluation. Over a period of 100 years the US dollar has lost 99% of its value against gold. Fiat currencies are destined to fail 100%, it is just a matter of when. When a fiat currency fails the new replacement fiat currency exchange rate is often around 1:10,000 to 1:1,000,000.

I am paid by my NHS employer with a digital type of promissory notes, "I promise to pay the bearer on demand the sum of ...", which appear in my bank account. These IOUs represent a commitment by the Bank of England to honour their face value. It is difficult to pinpoint what the "promise to pay" really means with the knowledge that all the banknotes (physical and digital) cannot actually be honoured. When I buy something, I settle my debt with these IOUs (digital promissory note). Settling a debt with a debt is forbidden in Islam by consensus.

5. The problem with fiat money from an Islamic perspective

Fiat money has inherent characteristics which violate Islamic values and principles such as uncertainty (gharar), fractional reserve banking, and the intrinsic connection between fiat money and riba (interest). Fiat money operates within a realm of uncertainty. When parties engage in transactions involving debt-based currency, they lack assurance regarding the debt holder’s capacity to fulfil obligations. The absence of tangible collateral (such as gold or silver) exacerbates this uncertainty, as fiat money derives its value solely from governmental fiat.

Fractional reserve banking, prevalent in contemporary financial systems, permits banks to lend beyond their actual reserves. This practice introduces additional uncertainty, as banks cannot simultaneously satisfy all outstanding debts. Fiat money’s reliance on fractional reserve banking compounds the inherent gharar in its transactions. Fractional reserve banking is like a house builder giving out multiple trust deeds for one house that he has built, this would be clearly fraudulent and criminal, yet private banks can do this legally with fiat money! Are banks above the rule of law when it comes to money?

By consensus, Sharīʿa principles prohibit transactions involving the exchange of debt for debt (bayʿ al-dayn bi’l-dayn). Paper currency exchanges often fall into this category, representing the transfer of debt without tangible collateral. Consequently, fiat currencies contravene established Sharīʿa norms.

Riba, the prohibition of usury, constitutes one of the seven major sins in Islamic tradition. Approximately 97% of fiat money creation occurs through debt issuance (loans), inherently linking fiat currency to riba. Muslims committed to financial integrity must explore alternatives that adhere to riba-free principles.

Beyond the legal and economic dimensions, a philosophical argument emerges. If an entire society operates within a corrupt and unjust financial system, the moral fabric of that society may erode. Fiat currencies, detached from tangible assets and susceptible to manipulation, contribute to this erosion. Muslim and other economically poor countries have been enslaved by debt under the fiat financial system to the extent that they have difficulty just paying off the annual interest on the money they have borrowed.

In the early 1970s, some Islamic scholars approved the use of fiat money without necessarily having full knowledge of its intricacies. Fiat money can be created out of thin air and lacks intrinsic value. It is concerning that a select group, namely bankers, legally possesses a licence to ‘print’ money legally, while it is illegal for everybody to do so. Such an arrangement raises questions about justice within society.

Regrettably, even Islamic banks in the UK, which offer Islamic mortgages, often adhere to practices similar to conventional banks. The fiat monetary system operates on debt, with money being conjured into existence simultaneously with the creation of debt. This linkage to debt is inherently tied to riba. The current financial system has the effect of transferring wealth from the poor to the rich, money becomes concentrated in the hands of the few who have control over the financial system, changing its rules and adjusting it for their own benefit.

Moreover, if everyone were to repay their debts, a significant contraction in fiat money would occur, potentially limiting trade and economic activity. The entire system relies heavily on debt and riba, prompting critical reflections on its fairness, ethics, and sustainability. With innovative technologies, increased efficiency and mass production we should see deflation occurring over time yet the debt-based financial system is designed to be inflationary. If look at the value of assets, such as houses and cars, with reference to Bitcoin everything has fallen in price. The value of our fiat money is guaranteed to decrease, there is no incentive to hold onto it. There appears to be something fundamentally wrong with the whole fiat currencies based financial system.

As of 2024, Pakistan's total public debt is about 125 US$ billion which is 35% of the gross domestic product. In 1948, the price of ounce of gold was 35 PKR in 2024 it is 660,000 PKR, an increase of almost 20,000%.

6. The problem with fractional reserve banking

Fractional reserve banking, while central to modern financial systems, faces significant criticisms due to its inherent vulnerabilities and broader economic impacts. A primary concern is the risk of bank runs, where banks cannot meet mass withdrawal demands because they only hold a fraction of deposits in reserve. This instability can lead to systemic crises, as seen during events like the 2008 financial collapse. Additionally, the practice contributes to inflation by expanding the money supply through lending, which can erode the purchasing power of currency. Critics also highlight moral hazards, as government-backed deposit insurance may encourage reckless lending by banks, knowing losses could be absorbed by taxpayers. Furthermore, fractional reserve banking has been linked to wealth inequality, as banks profit from interest on loans funded by depositor money, disproportionately burdening borrowers. These issues underscore ongoing debates about the sustainability and fairness of this system in ensuring financial stability and equitable economic growth

7. Is a return to the gold standard a feasible option?

- Under the gold standard, the money supply is directly tied to the available gold reserves. Gold standard would reduce flexibility permitted under fiat currencies.

- While the gold standard brings long-term price stability, it is historically associated with high short-term price volatility. Fluctuations in the availability and value of gold can lead to deflationary pressures, causing economic contractions, which can lead to recession.

- Gold standard would severely limit the ability of central banks to respond effectively to economic challenges.

- A gold standard could impact national security by restricting a country’s ability to finance defence and military expenditures during a war.

- Return to the gold standard would be extremely disruptive and detrimental to the US dollar.

- Some countries' central banks have been accumulating gold recently so we may see a return to a partial gold standard.

8. Gold-backed crypto-currencies - Is this the solution?

There are several gold-backed cryptocurrencies available today, including Tether Gold (XAUT), DigixGlobal (DGX), PAX Gold (PAXG), and Perth Mint Gold (PMGT). These tokens combine the stability of gold with the benefits of digital assets. They are backed by physical gold stored in secure vaults, and holders can redeem them for actual gold.

However, these tokens are not well-suited for use as everyday currencies due to a few limitations. First, they lack transaction speed—processing transactions can be slower compared to traditional digital currencies. Second, the tokens represent larger denominations (such as one ounce or one gram of gold), making them impractical for everyday purchases. Additionally, there is limited availability and merchant acceptance.

In summary, while gold-backed tokens offer stability and a link to physical gold, they are better suited as a store of value rather than as a currency for day-to-day transactions. Bitcoin although not asset-backed is the preferred choice amongst investors. Adopting one of these gold-back crypto-currencies would be just a repeat of the history of the gold-pegged US$ of the Bretton Woods system.

9. The advent of Bitcoin: A solution, an alternative or neither?

The concept behind Bitcoin is that solutions to computational puzzles have some value (extrinsic value) and computational work is used as a basis of trust. Bitcoin is an attempt to make use of our advanced technology to resurrect what money used to be. Bitcoin is not prone to riba nor inflation, thereby, the perpetual borrow, spend, consume cycle can perhaps be disrupted. Bitcoin is a digital asset which uses cryptography to generate (mine) new coins. New Bitcoins are generated by a process called Bitcoin mining. Bitcoin like fiat money is created out of nothing, and neither has any intrinsic value. However, fiat money creation involves debt and riba Bitcoin does not. The maximum number of Bitcoins which can ever be mined is set at 21 million equivalent to 2.1 x 1015 Satsoshis. However, there is no limit to the creation of fiat money. Here is a brief summary of what Bitcoin is:

A brief summary of Bitcoin mining

New Bitcoins can only be created by Bitcoin mining using computational power to solve mathematical problems. The Bitcoin ledger which is publicly available to anyone is called the Bitcoin blockchain. It consists of blocks containing transactions. The main purpose of Bitcoin mining is to update the Bitcoin blockchain, that is, to record Bitcoin transactions. Anybody can participate in updating the Bitcoin blockchain providing they have access to the internet and a powerful computer. To have the right to update the Bitcoin blockchain and get the reward for doing so, a miner has to guess a random 64-digit hexadecimal number (the hash) generated by the system using data in the previous block and the SHA256 algorithm. It is important to realise that the hash is not entirely random, it just looks random, the input determines the output (the hash) in an entirely unpredictable manner. The hash produced is cryptogenic which means it is infeasible to compute in the reverse direction you have to try to guess it with 2256 possibilities, which is 1077, in comparison the number of atoms in the universe is 1080. Each new block contains a unique timestamp, a blocker header, and a list of all the transactions in the block; the new block contains the hash of the previous block linking the blocks sequentially. Once a miner produces a new block he broadcasts it to the entire Bitcoin network of nodes. Upon receiving the new block other miners check that the hash meets the criteria and check that the transactions are legitimate, they then validate the block. This validation is called Proof of Work (PoW), acknowledging the miner did do the computational work. The Bitcoin blockchain is updated with all the miners have an updated version of the blockchain. The more computing power the greater the chance of guessing the hash. The mining difficulty varies to ensure each block in the Bitcoin blockchain is mined approximately every 10 minutes. So if the Bitcoin network's total computing power increases the difficulty in guessing the hash increases.

A brief summary of Bitcoin ownership and transaction

Bitcoins are said to be stored on a Bitcoin wallet but this is not strictly true. A Bitcoin wallet is a software program which allows you to access and control Bitcoins recorded on the Bitcoin blockchain (ledger). When you set up a Bitcoin wallet it generates a seed (recovery phrase). This seed phrase is used to generate a hierarchical deterministic (HD) wallet structure, from which all the private keys and addresses are derived. The wallet software will use a secure random number generator to generate a random private key from which it then generates a public key from which it generates a Bitcoin address. The private key is a 64-digit hexadecimal number. The private key (address) is only accessible to the owner and allows him to transfer Bitcoin to others from his Bitcoin wallet which has the private key stored. When you send money to another Bitcoin address the digital wallet creates a digital signature using your private key to prove that you are the owner of the Bitcoin associated with the address. The signature is unique for each transaction but generated using the same private key. All transactions reference unspent outputs (UTXOs). A Bitcoin transaction contains the sender's and recipient's Bitcoin addresses. Once a transaction is confirmed and added to the blockchain it becomes immutable. A seed (recovery) phrase of a Bitcoin wallet can be used to recover and restore your private key if your wallet is lost or destroyed. Each Bitcoin wallet address has a unique private key associated with it, although it is technically possible to import a private key from one Bitcoin wallet to another, in practice if you have Bitcoin on two different Bitcoin wallets this will be registered as belonging to two different owners with 2 separate private keys. The public address is visible to everyone and is used to receive Bitcoins into one's Bitcoin wallet.

It is important to understand the current fiat currency-based financial system, as explained above, before passing judgment on Bitcoin. Although Bitcoin was originally intended to be a medium of exchange it has become a store of value with adoption by large financial institutions and perhaps governments in the near future. Bitcoin is in a class of its own, different from every other cryptocurrency, its protocol is rooted in decentralisation and security.

10. Is Bitcoin halāl or harām?

New concepts and technologies can be difficult to comprehend and Muslim scholars disagree regarding the permissibility of Bitcoin. The opinions of Islamic scholars can be divided into three groups: the first group considers Bitcoin permissible; the second group allows Bitcoin with specific conditions; the third group (majority of fatāwa) considers Bitcoin to be harām.

The default position in Islamic commercial transactions (muʿāmalāt) is that everything is permissible (halāl) unless proven otherwise. In the absence of credible evidence to the contrary, Bitcoin is regarded as halāl by default. Let us look at arguments put forward by scholars who declare Bitcoin to be harām.

11. Arguments in favour of declaring Bitcoin to be harām / impermissible:

i. Lack of Central Control - Infringement on the rights of those in authority/ lack of legal protection

ii. Undefined ownership due to lack of central authority leading to excessive uncertainty (gharar)

iii. Lack of intrinsic value because Bitcoin is not asset-backed

iv. Lack of tangibility and usability

v. Retailers reluctance and Lack of status as legal tender

vi. Volatility and Speculation can resemble gambling and lead to interest-like gains (riba)

vii. Chance is involved in Bitcoin mining means validating transactions involves gambling

viii. Bitcoin is against the objective of the Sharīʿa (maqāṣid al-Sharīʿa) in terms of protecting wealth.

ix. Involvement in illegal activities

x. Pyramid scheme allegations

12. Counter-arguments against the impermissibility of Bitcoin:

Many of the arguments put forward by traditional Islamic scholars have been rejected by Muslim economists and those familiar with Islamic finance. Some of the objections are related to transactions rather than Bitcoin itself. Some of the arguments against Bitcoin put forward years ago are no longer applicable as our understanding has increased, the use of Bitcoin has matured and there is greater adoption. Here are some counter-arguments in favour of Bitcoin:

i. Lack of Central Control - Infringement on the rights of those in authority/ lack of legal protection

The absence of central control does not violate Islamic principles historically established for currencies. For Bitcoin to be considered as māl central control is irrelevant.

The decentralised nature of Bitcoin is integral to its conceptual framework; therefore, objections based on central control demonstrate a lack of understanding of this fundamental tenet. Lack of centralisation prevents manipulation as often happens with fiat-currencies. The Qur'ān does not have a centralised body in this world to secure its authenticity, many thousands of hufaadh (memorisers of the Qu'rān) around the world keep a copy of the Qur'ān in their hearts and together they act to maintain its integrity. They pass on this knowledge from individual to individual. A copy of the Bitcoin ledger is kept and updated by numerous nodes around the world in the Bitcoin network and the blockchain ensures the contents are immutable.

There are advantages to having central control of a currency as it assigns responsibility to an authority. The central authority for fiat currencies is the government of the country. Can governments be trusted and should Muslims trust non-Muslims with their wealth? Many would say, "No" to both these questions. History shows that governments cannot be trusted with money, most governments have manipulated the monetary system to the detriment of the public.

In 1933, the USA's Executive Order 6102 required all citizens in USA to deliver all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve in exchange for US$20.67 per ounce. In 1934 the statutory gold content of the US Dollar was revalued from US$20.67 to US$35 an ounce.

In 1935, Fascist Italy implemented an executive decree to collect gold from all holders in the country. In France, the government took a similar approach in 1936. It forced individuals holding more than 200 grams of gold to sell it to the Bank of France. In 1966, the UK government banned its citizens from owning more than four gold or silver coins, and private gold imports were blocked.

In 1944 the US government agreed with other major international governments to peg the US dollar to a fixed amount of gold (called the Bretton Woods Accord), however, in 1971 the US government unilaterally abandoned this agreement.

In 1979 the USA froze US$11 billion of Iran's assets; In 2021 the USA froze US$9.5 billion assets belonging to the Afghan central bank and more recently the USA has frozen US$300 billion of Russian assets. Central control has its drawbacks. These kinds of monetary seizures by central authorities can be avoided by use of Bitcoin.

A Bitcoin controlled by a government (or central authority) would give the government total surveillance and control of its people. Allowing it to control every individual's money allowing misuse of political power.

ii. Undefined ownership due to lack of central authority leading to excessive uncertainty (gharar)

Lack of a central authority does not mean there is uncertainty in ownership. The Bitcoin blockchain ensures double spending cannot take place. Bitcoin exchanges have been raided by hackers but that is a problem of security which could happen to a conventional bank being hacked for fiat money.

iii. Lack of intrinsic value because Bitcoin is not asset-backed

The absence of backing by tangible assets distinguishes Bitcoin from traditional commodity-backed currencies. However, this characteristic is not unique to Bitcoin, as fiat money also lacks such backing. Though Bitcoin does not have intrinsic value it does have extrinsic value given to it by its users and investors. One could argue that Bitcoin is backed by energy because it takes electricity to mine it.

iv. Lack of tangibility and useability

Bitcoin is an intangible asset. 90-97% of fiat money is also in digital form as 0s and 1s in a computer program. Intangible assets can have value as do computer programs such as Microsoft Office, digital licences and smartphone apps. The useability of Bitcoin is increasing slowly over time as some merchants accept. Usability will increase with price stability. The main usability of Bitcoin may be a store of value as institutional adoption increases. It may compete with or complement gold in this function.

v. Retailers reluctance and Lack of status as legal tender

Bitcoin's lack of legal tender status does not disqualify it as an asset (māl), as it can serve as a store of value irrespective of its function as a currency. The necessity of legal tender status for Bitcoin to qualify as a currency is debatable. Historically non-government-issued currencies were used in regions where Islam spread. El Salvador and the Central African Republic have adopted Bitcoin as legal tender. Bitcoin blockchain's constraint of approximately 7 transactions per second hinders its suitability as a medium of exchange, technological advancements may address these challenges in the future. The Lighting network built on the Bitcoin blockchain is a "layer 2" payment protocol which allows fast Bitcoin transactions at very low fees.

A number of companies and institutions do accept Bitcoin as payment. These include Microsoft, Paypal, Wikipedia, Homebase, Shopify, At&T and Starbucks amongst others.

vi. Volatility and Speculation can resemble gambling and lead to interest-like gains (riba)

Speculation and gambling-like trading has indeed taken place in Bitcoin trading, however, it is more prevalent in fiat-based forex trading and investing in stocks and shares. Virtually all investments in stocks and shares are based on some degree of speculation. "Spreading the risk" in investing means you have little or no idea which stocks or companies are likely to do well. Speculative transactions are forbidden in all forms of "investments"/money/ currencies. The introduction of spot Bitcoin ETFs and institutional adoption could potentially mitigate volatility by diversifying ownership and increasing liquidity. Furthermore, long-term holders cannot be accused of gambling.

vii. Chance is involved in Bitcoin mining means validating transactions involves gambling

The concept of guessing the hash plays a crucial role in Bitcoin mining. Guessing is involved with gaining the right to generate a new block not guessing the actual validating of transactions. This guessing involves time and energy, thereby differentiating it from pure gambling. The element of chance ensures that the individual with the biggest computer does not end up mining all the Bitcoins those with smaller computers also have a chance of mining the Bitcoin. Everyday trade in real life involves an element of chance.

viii. Bitcoin is against the objective of the Sharīʿa (maqāṣid al-Sharīʿa) in terms of protecting wealth

Those who speculate on the price of Bitcoin can lose a lot of money but those who have held on to Bitcoin on a medium to long-term basis have made substantial gains. There is increasing adoption of Bitcoin by institutional investors and accumulation by governments. About 2.2% of all Bitcoin is held by governments and Bitcoin ETFs hold hundreds of millions of US dollars worth of Bitcoin unlike fiat money is inflation proof thereby maintaining its value over time. In reality, Bitcoin is increasingly being used by retailers and institutions to protect wealth on a long-term basis.

The Bitcoin Act of 2024, introduced by U.S. Senator Cynthia Lummis, proposes the establishment of a Strategic Bitcoin Reserve to bolster the U.S. economy and strengthen the dollar against inflation. The bill outlines a plan for the U.S. Treasury to purchase up to 1 million Bitcoin (around 5% of the total supply) over five years. The U.S. Treasury may sell its gold reserves to buy Bitcoin. It is likely this move by the U.S. Treasury will be followed by all other Western countries. This will have a huge positive effect on Bitcoin price and establish Bitcoin as a store of wealth beyond doubt.

Recently, the Shenzhen Court of International Arbitration (SCIA) has recently affirmed that cryptocurrencies, specifically bitcoin and several of its hard forks, are considered legal property and Chinese citizens have a right to own and transfer them.

MicroStrategy under it's "21/21 Plan" intends to buy USD42bn worth of Bitcoin in the next 3 years.

2025 could see a huge demand for Bitcoin, it may actually become digital gold.

ix. Involvement in illegal activities

Instances of Bitcoin's involvement in illegal activities, including terrorism, mirror similar occurrences with fiat currencies. Statistical analyses suggest that criminal activity in Bitcoin transactions is relatively low compared to that in US$ transactions, challenging the notion that Bitcoin's use in illegal activities renders it inherently problematic.

x. Pyramid scheme allegations

This is a speculative claim against Bitcoin without any evidence. While some newer altcoins may exhibit characteristics of pyramid schemes, Bitcoin does not align with this classification. Some financial experts consider fiat currency economies as a classical Ponzi scheme. For Bitcoin to be a Ponzi scheme requires someone at the top (central control) to operate the Ponzi scheme, but there is no central control. Bitcoin's code is open source and available online for anyone to examine. Bitcoin's ledger (the blockchain) with all the transactions is also publicly available in real-time for anyone to view or download.

If all the arguments put forward to declare Bitcoin harām can be refuted then Bitcoin returns to its default status of being halāl. A number of fatawa issued declaring Bitcoin to be harām was when Bitcoin price was relatively low, if those scholars were to review their fatawa and reverse their decision, declaring Bitcoin to be halāl, it would generate a lot of anger as the price of Bitcoin has multiplied several fold.

An ideal Sharīʿa-compliant cryptocurrency would have the security of Bitcoin, backed by audited physical gold reserves like Tether Gold and the transaction speeds of Solana but is unlikely to happen, perhaps not even possible.

Currently, Bitcoin cannot be said to have all the qualities of a currency nor all the qualities of wealth (māl). If common people assign an (extrinsic) value to Bitcoin by common agreement and start using it in common everyday transactions then Bitcoin will take on the properties of being a currency. Bitcoin may end up being used as a currency amongst a small population. It's usage as storage of value (wealth) is increasing rapidly. Currently over 300 million people own Bitcoin worldwide and its market capitalisation is approximately £1,000,000,000,000.

The Fiqh Council of North America issued a fatwa in 2019 stating that Bitcoin is essentially halāl and should be treated similarly to fiat currencies. So even though Bitcoin is essentially halāl certain transactions involving Bitcoin may be harām.

Just because some scholars consider Bitcoin to be halāl does not imply you should buy or invest in Bitcoin. If you are in any doubt it is better to refrain. Sharīʿa-compliant dealing in Bitcoin may be an opportunity for some HNWIs who understand what they are dealing with, its limitations, risks and rewards. At present, it does not seem a suitable option for everyone. It is still highly speculative. Over time things may change and become clearer. In general do not "invest" in anything unless you have a very good understanding of what you are investing in otherwise it is merely speculation, which can be akin to gambling.

13. Bitcoin as a Potential Reserve Asset

Most Sharīʿa rulings have focused on the permissibility of Bitcoin being used as a currency, however, Bitcoin is an evolving concept and Bitcoin is increasingly being considered as a potential reserve asset for central banks due to its unique characteristics. As a decentralized digital currency with a finite supply, Bitcoin offers several advantages that make it an attractive option for diversifying reserve portfolios. Its performance during economic crises, particularly when traditional financial systems face challenges, has demonstrated its resilience. Bitcoin's low correlation with other assets makes it an effective portfolio diversifier, potentially helping central banks hedge against various risks, including inflation, geopolitical tensions, and financial sanctions. Additionally, Bitcoin's lack of default risk, as it doesn't depend on future cash flows or counterparty commitments, further enhances its appeal as a reserve asset. While adoption by central banks is still in its early stages, the growing interest in Bitcoin as a reserve asset reflects its potential to complement traditional reserve holdings like gold and provide a hedge against economic uncertainties.

_____________________________________________________________________________________

14. Succession of Crypto-assets: Challenges and Solutions

As the number of Muslims in the UK acquiring digital assets, including crypto-assets, is increasing solutions have to be developed which provide secure methods for their transmission to the legal heirs upon death. Failure to provide access to these assets to family members may result in their permanent loss. It is your duty to ensure your wealth and property is transmitted to your heirs correctly as the preservation of wealth is one of the most important objectives of the Sharīʿa.

The secure nature of crypto-assets means they can become inaccessible if private keys or seed phrases aren’t left for personal representatives. Even with access details, PRs may not know about the devices or apps needed to retrieve these assets. Revealing these tools to PRs is as crucial as leaving access instructions. However, digital assets’ transfer upon death is complicated by the non-enforceability of digital wills in England and Wales, necessitating a valid physical will for proper asset distribution. This creates a multifaceted challenge in managing the inheritance of digital assets.

From an Islamic viewpoint, it’s crucial to clearly identify the rightful owner of assets to ensure their smooth and prompt transfer after death, thereby reducing the risk of disputes and asset loss. The testator has a duty to undertake all necessary legal steps to guarantee this process.

i. Physically writing down private keys (seed phrase) Crypto-asset holders often hesitate to document their private keys and seed phrases due to fraud concerns. However, without such information, resolving inheritance issues becomes difficult. If holders choose not to disclose access details posthumously, they should consider leaving a letter of wishes to prevent personal representatives and beneficiaries from wasting efforts on assets that remain encrypted and inaccessible.

ii. Online custodial services Online custodial services offer a solution for securely storing and bequeathing crypto keys and seed phrases, with some providing decentralised security. These services allow users to appoint guardians for posthumous multi-factor authentication and beneficiaries to inherit crypto-assets. However, they blur the lines between legal and beneficial ownership, raising questions about the nominee’s role and the distribution of assets according to the deceased’s will. This ambiguity could lead to disputes and litigation, especially if the nominee transfers assets before the estate is settled.

iii. Using a Smart Wallet A smart wallet, or account abstraction, uses a smart contract to manage the wallet, allowing for private keys to be reset via social recovery, preventing permanent lockout.

iv. Social recovery Social recovery in crypto allows account holders to appoint ‘guardians’—trusted individuals who can collectively generate a new private key if needed, without knowing the original. This method not only secures access but also helps differentiate legal from beneficial ownership, as guardians only facilitate key recovery, not asset control.

v. Multi-signatory Authorisation Smart wallets can be set up for multi-signatory authorisation, allowing for legacy wallets where transactions require both the creator and beneficiary’s consent. While this secures assets and facilitates inheritance tax settlements, it raises questions about whether the wallet is treated like a joint account upon death, potentially affecting inheritance tax implications and the distribution outside of a will. This underscores the importance of traditional estate planning alongside smart wallet usage.

Multi-signatory authorisation smart wallets are being used to secure loans collateralised against Bitcoin, showing that the method is workable in practice. Multi-signatory authorisation smart wallets prevent re-hypothecation.

vi. Superbacked - A cheap solution

Superbacked is a cheap solution to passing on crypto-assets to your heirs.

This is a novel program which encrypts your private keys (seed phrase) into a number of QR codes. These QR codes can then be printed and distributed to a number of individuals (heirs). The original private keys can only be retrieved by a combination of QR codes. During encryption, you determine how many of the QR codes are required to retrieve the original private keys (seed phrase). It is important that the superbacked program is run on a computer not connected to the internet as well as the printer used to print out the QR codes for security reasons.

This is a rapidly evolving subject and more and more solutions are likely to be introduced.

A. Hussain, 2024 with update 2025

Related articles:

Islāmic Will and Inheritance Tax (IHT